Business

Report: Biden’s Economic Plans Would Mean 5 Million US Jobs Lost, 10% GDP Drop

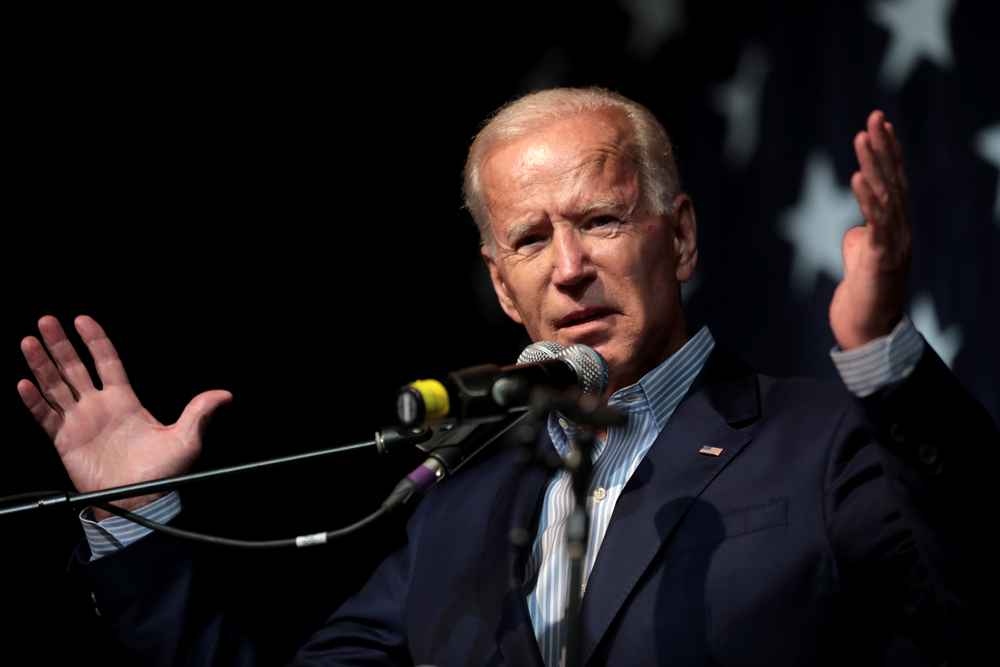

A Joe Biden presidency would destroy millions of jobs and derail the economic recovery from the coronavirus pandemic. This is according to a new report from the Hoover Institute at Stanford University.

The report says that based on the economic plans laid out by Biden, nearly 5 million Americans would lose their full-time job. Meanwhile, the country’s gross domestic product, the measure of its economic output, would drop by nearly 10% over the next decade.

These losses would trickle down to the average household. The median household income will fall by $6,500 per year by 2030, according to the report.

Derailing Economic Recovery?

The authors of the report lay out a laundry list of changes. These changes include reversing some of President Trump’s 2017 Tax Cuts And Jobs Act, a tax increase on corporations and high-income households and pass through entities, reversing much of the regulatory reform of the past three years as well as setting new environmental standards, and create or expand subsidies for health insurance and renewable energy.

When it comes to renewable energy, the report says that the proposal to cut our nation’s reliance on fossil fuels is “ambitious” and would require cutting electrical use back to levels not seen since 1979.

“These plans are ambitious. Unless people drive a lot less, the electrification of all, or even most, passenger vehicles would increase the per capita demand for electric power by about 25 percent at the same time that more than 70 percent of the baseline supply (i.e., electricity generated from fossil fuels) would be taken off line and another 11 percent (nuclear) would not expand. To put just the 25 percent in perspective: that is the amount of the cumulative increase in electricity generation per person since 1979, which is a period when nuclear and natural gas generation tripled.”

Taxing Wealthy Americans

To pay for most of these “ambitious” plans, Biden has already said he would significantly raise taxes on wealthy Americans. They, he says, include anyone who earns more than $400,000 per year, through higher taxes, an increase in the payroll tax that funds Social Security, and fewer tax deductions. He also plans on raising the corporate tax rate.

The Penn Wharton Budget Model, a nonpartisan group at the University of Pennsylvania's Wharton School, says nearly 80% of Biden’s proposed tax increases would affect the top 1% of earners in the United States. It will primarily do so through raising the top individual income tax bracket to 39.6% from 37% for those earning more than $400,000 annually.

That means an annual tax increase of nearly $300,000 for households in the top 1%, according to the Tax Policy Center, who say even middle-class families will see a tax increase under Biden’s plan.

Corporations would feel the pinch as Biden said he would raise the corporate tax rate from 21% to 28% on “day one.”

During an interview in September, Biden said, “I'd make the changes on the corporate taxes on day one. And the reason I'd make the changes to corporate taxes, it can raise $1.3 trillion if they just started paying 28% instead of 21%. What are they doing? They're not hiring more people.”

Up Next:

1 Comment

I am a 65 yr old voter. My opinion on Biden is that he’s a team player. He listens to all, not it’s all about me as Trump does. Trump takes all the credit if he by chance does something right but if He is wrong all the blamefalls on his “advisors”. Have you noticed how many have quit? Trump has time after time dishonestly placated to the American people but does what he wants to with disregard to the people. Yes suburban woman don’t care for him he is attempting to take us women back to the days of Susan B Anthony. With his pro life views says it all. It’s not him who has to carry the burden of bearing a rapist’s child or from incestual violation. He was born with a silver spoon & can throw any burden to the hired help. He has afforded so much from claiming Bankruptcy eliminating all his financial mistakes like it never happened. Sure now he can afford everything by using the American people’s tax dollars, but not from his cronies The Fellow Rich who just keep getting richer. Isn’t our wonderful President in personal debt? I think so. Now he has an endless supply, he can just oder more $ to be made. Eventually when he is gone the American people will end up taking the brunt end of paying it back. It also devalues the almighty dollar. American made doesn’t come cheap & his ideas open the door wider to inflation. Donald Trump is NOT for the American people he is for Donald Trump ONLY. He has already proved it by ignoring those who are prominent in their field ie: Dr.s & Scientists, dismissing them & their facts on covid-19 & global warming. He is not good for this country, he is an embarrassment.