Commodities

Greenback’s Biggest Decline Since 2009

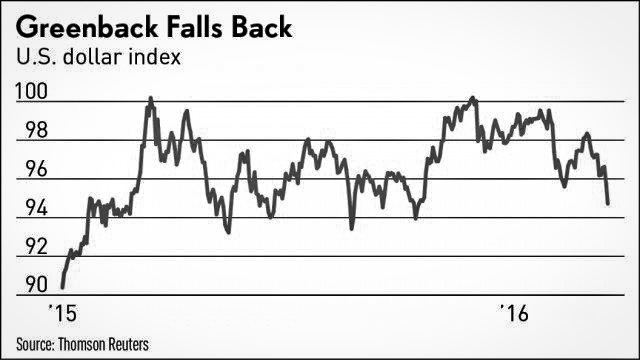

The dollar took a deep plunge Wednesday and Thursday as the Federal Reserve scaled back expectations for interest-rate increases in 2016.

The U.S. currency slid against a basket of other currencies as the central bank cited the potential impact from weaker global growth.

The dollar fell sharply for a second straight day to five-month lows Thursday on the Federal Reserve’s less-ambitious rate-hike plans. That in turn boded well for corporate earnings, lifting the S&P 500 to its highest level of the year.

The Fed signaled Wednesday that it wants to make sure the economy builds up some momentum before it resumes normalizing interest rates. That was a much more inviting message than in December, when policymakers hiked for the first time in nearly a decade. They also promised at that time a steady diet of rate hikes in 2016 — despite a strong dollar, weak earnings, tepid growth and a plunge in commodity prices that raised fears of emerging market defaults.

The central bank indicated that it now sees only two hikes this year, with markets still expecting only one tightening step.

With the Fed no longer working at cross-purposes from other major central banks — the European Central Bank, Bank of Japan and People’s Bank of China — as they aim to stimulate growth, commodities prices continued to rally, particularly in dollar terms. Crude oil prices rose above $40 a barrel for the first time in 2016.

The U.S. dollar index, which measures its value against a basket of major currencies, fell below 95, down from 97 before the Fed decision and a 52-week high just above 100. It was the biggest two-day decline since 2009. The dollar index had been as low as 80 as recently as July 2014, before the Fed began to point to a 2015 rate hike as other central banks doubled down on quantitative easing with a side of negative rates.

The euro rose to $1.13 on the dollar and is now closer to its 52-week high of $1.17 than its low of $1.05.

Alphabet To Wal-Mart Should Benefit

The weaker dollar is positive for the export sector’s competitiveness, provides a boost to earnings for companies sell a lot of their products overseas and should ultimately lead to more capital investment in the U.S., said Steve Blitz, chief economist at ITG Investment Research.

The S&P 500, home to multinational giants, rose 0.7% to its best level since Dec. 31.

Companies from Wal-Mart (WMT), to Apple (APPL), General Electric (GE) and Google parent Alphabet (GOOGL). All have cited big negative impacts from currency swings in recent quarters. General Electric shares rose 2.6% on Thursday, breaking out of a cup-with-handle base. Alphabet edged higher, but Wal-Mart and Apple shares fell modestly.

The Fed’s statement on Wednesday noted net exports and business investment as two economic soft spots.

Yet the U.S. manufacturing sector, which has been stabilizing, may be showing early signs of an upturn. Regional Fed surveys from the New York and Philadelphia areas this week showed surprising, if modest, strength. U.S. manufacturing output rose in the first two months of the year, led by business equipment.

U.S. tourism also stands to get some help from the weaker dollar, which may translate to higher hotel rates in major tourist destinations like New York, Blitz said.

While the U.S. benefit of a weaker dollar has to be weighed against what it means for the eurozone or Japan, the greenback’s strength had appeared to exacerbate growth concerns in China, which has been trying to ease the yuan’s peg to the dollar without panicking investors.

[buffet_recommended]

Risk On, Dollar Off?

The dollar typically appreciates “whenever there is a flight to safety,” said Sara Johnson, IHS Global Insight research director, so it’s not surprising to see a reversal in flows amid an improvement in confidence in the global economy.

“The risks are still lurking but we have seen a notable improvement in recent weeks,” she said.

The euro has been rallying against the dollar since the ECB cut its interest rate on bank deposits further into negative territory but President Mario Draghi indicated that further interest-rate cuts weren’t expected.

Now, with the Fed signaling “it’s going to be a year of continued accommodation,” the divide between the central banks isn’t so stark, said Lindsey Piegza, chief economist at Stifel Fixed Income.

Vasileios Gkionakis, global head of currency strategy at UniCredit Research, wrote that the dollar “is set for a multi-quarter decline, correcting a sizable overshooting.”

Source: http://www.investors.com/news/economy/easier-fed-means-weaker-dollar-stronger-earnings/