Newsletters

The Capitalist Newsletter – October 20, 2016

GOOGLE LAUNCHING WEB TV PLATFORM; CBS ALREADY ON BOARD |

|

Winners & Losers – Banc of California (BANC) Rebounds UP (18.38%) After Denying Claims of Con Man Ties – Puma Biotechnology, Inc. (PBYI) Shares Drop DOWN (18.90%) After Announcing Secondary Offering

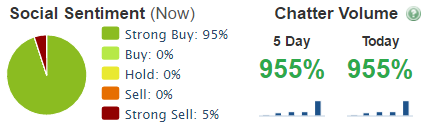

Most Talked About Halliburton Company (HAL) a Strong Buy According to the Masses After Posting Surprise Profits as Expenses Fall

The TIP Sheets -Wednesday, October 19th – Opus Bank (OPB) Shares Drop DOWN (11.61%) After Announcing Loan Charge-Offs Will Impact Third Quarter Earnings, Which Should Result in a Net Loss for the Company. Expect Shares to Continue DOWN

Unusual Volume

– Rite Aid Corp. (RAD) Falls DOWN (5.13%) on 55 Million Shares Traded After Kroeger Pulls Out of Deal to Buy 650 Stores, Jeopardizing Walgreen’s Plans to Acquire Rite Aid Due to Anti-Trust Regulations. Expect Shares to Continue DOWN |