News

Got $1 Billion Investment Money? Trump Promises Faster Approval For Your Business

Source: YouTube

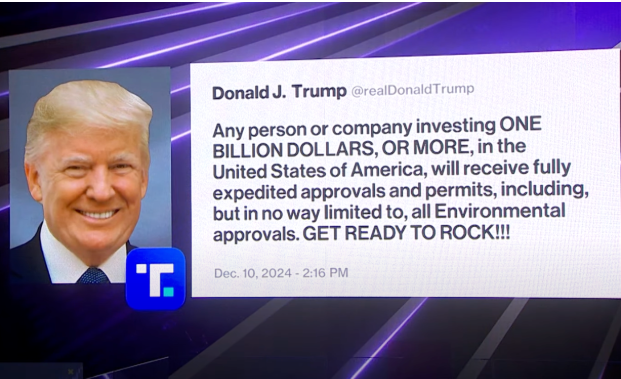

President-elect Donald Trump announced a bold initiative on Tuesday to attract large-scale investments into the United States. In a post on Truth Social, Trump pledged expedited regulatory approvals, including environmental permits, for anyone or any company committing at least $1 billion investment capital. The plan, unveiled without specific details, signals Trump’s commitment to revitalize the economy through deregulation.

A Strategic Move to Attract $1 Billion Investment Capital

Trump’s proposal seeks to address long-standing complaints from investors and developers about regulatory hurdles. By streamlining approval processes, the plan aims to attract major investments in industries like energy, manufacturing, and infrastructure.

This approach marks a stark contrast to the policies of outgoing President Joe Biden, whose administration prioritized tax credits and subsidies for clean energy projects. Instead of these incentives, Trump’s strategy leans heavily on reducing red tape to foster a pro-business environment.

One potential example of the plan's beneficiaries could be liquefied natural gas (LNG) developers. Trump’s transition team is reportedly preparing to expedite export permits for LNG projects, alongside increasing oil drilling on federal lands and off U.S. coasts. Elon Musk, a vocal Trump supporter, praised the initiative, calling it “awesome” on social media.

High-Stakes Investments: Success Stories

Trump’s $1 billion investment threshold sets a high bar, but such large investments have historically yielded significant economic benefits. For example:

- Foxconn Technology Group: The Taiwanese electronics giant invested $10 billion in a Wisconsin manufacturing facility, creating thousands of jobs and boosting local supply chains.

- Tesla Gigafactories: Elon Musk’s Tesla has invested billions in facilities across Nevada and Texas, spurring innovation and economic activity in renewable energy and electric vehicles.

- Intel Semiconductor Plants: In response to global chip shortages, Intel announced a $20 billion investment in two U.S. semiconductor plants, strengthening the domestic tech industry.

These examples highlight the transformative impact such large-scale projects can have, both regionally and nationally.

Challenges and Controversies

Despite its promise, Trump’s plan for $1 billion investment commitments raises many questions. Environmental groups are particularly concerned about the proposal’s emphasis on fast-tracking permits, fearing it could undermine essential safeguards for clean air and water.

Critics also argue that the $1 billion investment floor may favor large corporations while excluding smaller-scale projects that could bring similar localized benefits. Moreover, Trump has not detailed how expedited approvals will navigate existing legal frameworks, especially those involving independent agencies like the Federal Energy Regulatory Commissio.

Potential Impact on Key Industries

Trump’s plan could accelerate investment in sectors that have struggled under regulatory constraints. For instance:

- Energy: Streamlined approvals for pipelines, drilling, and LNG facilities could bolster U.S. energy independence and reduce reliance on imports.

- Infrastructure: Permitting relief could fast-track large-scale projects like highways and transmission lines, aligning with broader goals of economic revitalization.

- Manufacturing: Reduced red tape may encourage more companies to build factories in the U.S., creating jobs and strengthening supply chains.

At the same time, critics warn that deregulation could lead to environmental degradation and undermine community input on major developments.

A Broader Economic Vision

Trump’s $1 billion investment plan aligns with his broader vision of deregulation. During his first term, he introduced Executive Order 13771, requiring the removal of two regulations for every new one enacted. He now pledges to expand this approach by eliminating ten regulations for each new rule.

This strategy reflects a return to Trump’s core economic philosophy: creating an attractive business environment to drive growth, innovation, and job creation. However, it also risks reigniting debates over balancing economic expansion with environmental and social responsibilities.

Do you think Trump’s $1 billion investment plan will attract the right kind of growth for the U.S. economy? Tell us what you think!