News

Trump To Announce New Tariffs On Steel and Aluminum Imports

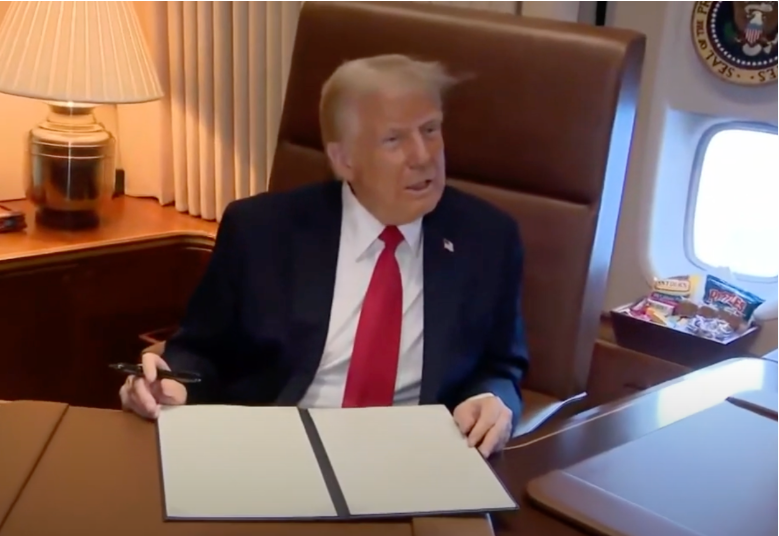

Source: YouTube

President Donald Trump is set to announce new tariffs on Monday, targeting all U.S. imports of steel and aluminum with a 25% duty. While this move aims to protect American industries, it brings a host of implications for manufacturers and the broader economy. These new tariffs follow previous measures that targeted other industrial metals like copper, all of which add further strain on key manufacturing sectors.

A Historical Look at Steel, Aluminum, and Industrial Metal Imports

The U.S. has long relied on imported steel, aluminum, and other industrial metals to meet its industrial needs. In 2017, before the first round of tariffs, the U.S. imported about 34.5 million metric tons of steel. After the 2018 tariffs, steel imports dropped by 27% to around 25 million metric tons by 2019. However, domestic production only increased by two-thirds of the import reduction, leading to supply constraints.

Copper and other industrial metals have also faced tariff pressures in recent years. Since 2018, tariffs on Chinese copper and certain metal alloys have contributed to fluctuating prices and supply disruptions. By early 2025, the price of copper surged, driven in part by tariff-related market shifts. This added cost pressure has impacted industries like electronics, construction, and renewable energy, where copper is a critical component.

Canada, Brazil, Mexico, South Korea, and Germany are the top steel suppliers to the U.S. As of January 2025, Canada accounted for nearly 25% of American steel imports, while Mexico contributed about 12%. For aluminum, Canada remains the leading exporter to the U.S., followed by the United Arab Emirates and Russia. Notably, China’s direct exports of steel and aluminum to the U.S. are minimal due to existing tariffs, but its dominance in global production indirectly affects U.S. markets.

Implications for American Manufacturers

The new tariffs could significantly impact American manufacturers. Industries like automotive, aerospace, construction, and infrastructure rely heavily on steel, aluminum, and copper. Higher tariffs will increase production costs, as imported materials become more expensive and domestic producers raise prices due to reduced competition.

For example, the automotive industry, which uses steel for car frames, aluminum for lightweight components, and copper for electrical wiring, could see production costs rise by as much as 5-10%. This increase may lead to higher vehicle prices for consumers. Similarly, construction companies might face inflated costs for building materials, affecting everything from residential housing to large-scale infrastructure projects.

China's Role in the Global Market

While China exports little steel directly to the U.S., it remains at the heart of the global steel, aluminum, and copper markets. China produces as much or more steel annually as the rest of the world combined and is a dominant player in the copper industry. Recently, a slowdown in China's domestic demand has led to an increase in its metal exports, flooding global markets and driving down prices.

This surplus has affected U.S. allies like Canada and Mexico, who import Chinese metals, process them, and then export them to the U.S. The new tariffs could disrupt this supply chain, potentially straining relationships with key trade partners and leading to retaliatory measures.

Potential Industry Reactions

American steelmakers and labor unions have long supported tariffs as a means of protecting domestic jobs and production. The American Iron and Steel Institute (AISI) praised the prospect of new tariffs, emphasizing the importance of a strong domestic steel industry for national security and economic prosperity.

However, not all reactions are positive. Manufacturers dependent on imported metals are concerned about rising costs and supply chain disruptions. The European Union has already indicated it will retaliate if tariffs affect its metal exports to the U.S., which could escalate into broader trade conflicts.

Trump’s new tariffs on steel, aluminum, and other industrial metals aim to bolster American industries but come with significant risks. While they may protect domestic producers in the short term, the long-term implications for manufacturers, consumers, and international trade relations remain uncertain.

Do you think new tariffs will strengthen or harm American manufacturing? Tell us what you think!