Newsletters

The Capitalist Newsletter – December 28, 2016

U.S. DOLLAR SURGES; BUT COMES WITH A CATCH |

|

Winners & Losers – Conatus Pharmaceuticals, Inc. (CNAT) Soars UP (37.92%) After Analyst Buy Reiteration Following Collaboration and License Agreement with Novartis – Endologix, Inc. (ELGX) Tumbles DOWN (26.70%) After Investigation into Medical Device Manufacturing Issue Causes Company to Halt Shipments of its Top Product

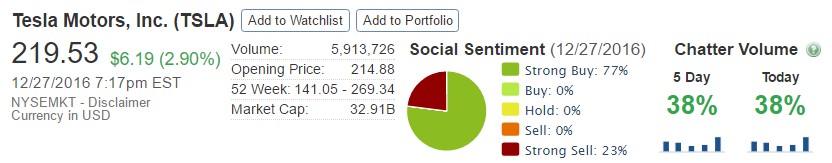

Most Talked About Tesla Motors, Inc. (TSLA) Sees Uptick in Chatter, Considered Majority Strong Buy After Panasonic Increases Stake in Partnership and Companies Begin Producing Solar Cells in Buffalo Plant.

The TIP Sheets – Tuesday, December 27th – Seattle Genetics, Inc. (SGEN) Plummets DOWN (15.36%) After Announcing FDA Has Put a Clinical Hold on Multiple Early Stage Clinical Trials Testing its Cancer Drug. Expect Shares to Continue DOWN

Unusual Volume

– Conatus Pharmaceuticals, Inc. (CNAT) Soars UP (37.92%) on 23.5m Shares Traded After its Buy Rating is Reiterated by Analysts Buy Reiteration Following Collaboration and License Agreement with Novartis. Look For Shares to Continue UP |