News

Treasury Secretary Scott Bessent Warns That Days of Heavy Government Spending Are Over

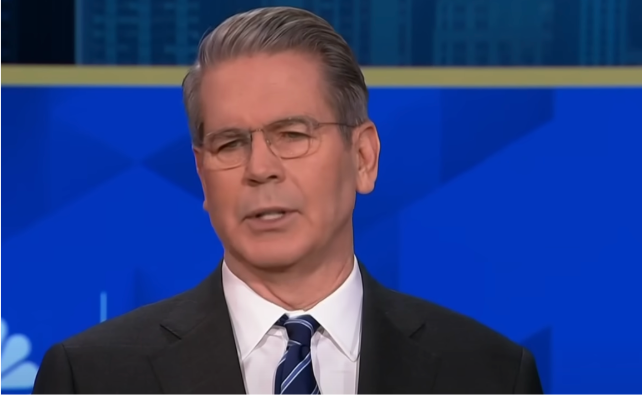

Source: YouTube

Treasury Secretary Scott Bessent has issued a stark warning about the future of the U.S. economy, stating that the nation is entering a “detox period” as it transitions from years of high government spending to a more private-sector-driven economy. His comments come as financial markets react negatively to new tariffs imposed by President Donald Trump on Canada, Mexico, and China.

Bessent’s remarks, made during an interview on CNBC’s Squawk Box, reflect concerns that the U.S. economy has become overly reliant on government intervention. “The market and the economy have just become hooked. We’ve become addicted to this government spending, and there’s going to be a detox period,” he explained. The question now is whether the shift in economic policy will stabilize long-term growth or push the economy toward deeper uncertainty.

Market Reaction to Government Spending Cuts and Tariffs

The financial markets have responded with volatility following the administration’s policy shifts. The stock market suffered a weeklong plunge, triggered by the president’s announcement of 25% tariffs on imports from Canada and Mexico and an additional 10% tax on Chinese goods. While Trump later agreed to temporarily pause some tariffs under the U.S.-Mexico-Canada Agreement (USMCA), uncertainty remains as reciprocal tariffs could take effect in April.

Meanwhile, the latest jobs report showed that the U.S. added 151,000 jobs in February—lower than Wall Street’s expectations of 163,000. Additionally, job cuts hit their highest level for February since 2009, with over 172,000 layoffs reported. The unemployment rate also signaled trouble when it rose from 4.0% in January to 4.1% a month later.

Trump’s Trade War and Economic Vision

President Trump remains firm in his belief that tariffs will ultimately strengthen the American economy. Speaking before Congress, he acknowledged the short-term pain but insisted, “Tariffs are about making America rich again. There will be a little disturbance, but we’re OK with that.”

Treasury Secretary Bessent echoed this sentiment, arguing that the economy must move away from excessive government spending toward policies that encourage private sector investment. “The American dream is to be able to buy a house,” he said, emphasizing the administration’s focus on lowering interest rates to make homeownership more accessible.

However, critics warn that these policies could exacerbate economic instability. The Federal Reserve’s efforts to control inflation through rate cuts have yet to yield the expected stability, and consumer sentiment has fallen sharply. February’s Conference Board consumer confidence survey saw its steepest one-month decline since 2009, reflecting growing economic anxiety.

Will Reduced Government Spending Revitalize the Economy?

Bessent maintains that the shift away from heavy government spending is necessary, but the success of this strategy remains uncertain. While tax cuts and deregulation are designed to encourage business investment, a weakened labor market and rising layoffs could pose challenges to economic recovery.

One key concern is how tariffs will affect consumer prices. While Bessent downplayed the risk, calling tariffs a “one-time price adjustment,” the reality is that increased costs on imports could squeeze household budgets. The administration argues that forcing other countries to lower trade barriers will ultimately benefit American workers, but businesses remain wary of prolonged trade disputes.

With economic uncertainty mounting, the next few months will be critical in determining whether the administration’s strategy can deliver long-term growth or if the U.S. economy is headed for a deeper slowdown.

Will shifting from government spending to private sector growth strengthen the U.S. economy? Tell us what you think!

1 Comment

We are at an unstable juncture in America, I am in full agreeable things have to change , although , the massive cuts resulting in no actual criminals being charged seems to be quite excessive, only ones being affected are the workers, appears to me as though the upper level employees are the ones doing the criminality