News

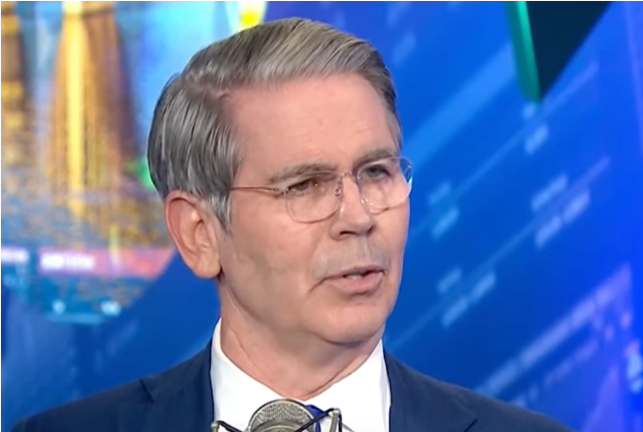

Business Leaders React Positively to Trump’s Appointment of Scott Bessent as Treasury Secretary

Source: YouTube

Scott Bessent’s appointment as Treasury Secretary under President-elect Donald Trump has been widely praised by business leaders and financial markets. A seasoned global investor, Bessent has worked with legends like George Soros and Stanley Druckenmiller, building a reputation as a pragmatic and bipartisan figure. This background has calmed fears among investors wary of Trump’s more unpredictable economic policies. Markets rallied in response, with the Dow hitting a record 44,737 points. Treasury yields ticked downward, reflecting newfound optimism about stable fiscal policies ahead. JPMorgan Chase CEO Jamie Dimon called Bessent an “excellent choice,” reflecting broader optimism that his expertise can provide a stabilizing influence. However, while Wall Street celebrates, skepticism lingers about whether this appointment will translate into tangible benefits for everyday Americans.

Business leaders like Jeffrey Sonnenfeld noted that Bessent’s pragmatism could serve as a moderating influence on Trump’s bolder economic moves. His bipartisan history reassures skeptics who worry about over-politicized policies. However, not all voices are enthusiastic. Progressive leaders like Senator Elizabeth Warren argue that the incoming Treasury Secretary’s background in hedge funds may cater more to investors than working-class Americans.

A Hedge Fund Veteran in a Higher-Stakes Role

Bessent’s career as a hedge fund executive has been marked by strategic brilliance and bipartisan political contributions. His pragmatic approach aligns well with Wall Street’s priorities, but his history may draw criticism from Trump’s working-class base. As Treasury Secretary, Bessent will act as Trump’s “quarterback,” executing the administration’s economic agenda, including tax reforms and tariff negotiations. Notably, Bessent supports selective tariffs but opposes sweeping measures akin to the 1930s Smoot-Hawley Act, which worsened the Great Depression. This nuanced stance could moderate Trump’s more aggressive trade policies, yet it also raises questions about potential conflicts with Trump’s famously populist style.

Critics argue that Bessent’s expertise primarily serves wealthy investors, not the struggling middle class. For instance, while the new Treasury Secretary expressed support for Trump’s tariff plans as leverage in trade negotiations, he remains cautious about their inflationary effects. In a recent interview, he stated, “Tariffs can’t be inflationary because if one price rises, consumers adjust their spending on others.” Such comments, though grounded in economic theory, may face scrutiny as inflation concerns remain high among voters.

The Big Business Cabinet: A Boon or a Liability?

Bessent’s appointment as Treasury Secretary comes alongside Howard Lutnick, a billionaire investor tapped as Commerce Secretary. Both picks signify Trump’s reliance on Wall Street veterans to shape his economic policies. While this may reassure markets, it could alienate parts of Trump’s base who expected more populist appointments. Lutnick and Bessent share a free-market ethos but differ in temperament. Lutnick’s aggressive style contrasts with Bessent’s measured approach, potentially creating friction within the administration. Still, their shared understanding of global markets might temper Trump’s tariff-heavy instincts, promoting targeted trade policies instead.

Observers are watching closely to see if Trump’s instincts will clash with his appointees’ strategies. Historically, Trump has oscillated between market-friendly measures, like tax cuts, and protectionist tariffs that worry investors. Bessent’s ability to navigate these dynamics will define his legacy as Treasury Secretary. Lutnick’s focus on trade policies could either complement or conflict with Bessent’s financial expertise. The relationship between these two appointees may significantly shape the administration's economic trajectory.

Will Bessent Influence Trump’s Economic Vision?

Despite his pedigree and bipartisan appeal, Bessent’s success depends on his ability to influence Trump’s economic priorities. His pragmatic stance on tariffs and fiscal policy could prevent inflationary risks, but Trump’s track record suggests that ultimate decisions may bypass even the most capable advisors. Bessent’s appointment signals a willingness to incorporate Wall Street expertise into Trump’s economic agenda. However, this alignment could backfire if Main Street perceives it as catering exclusively to the wealthy.

The stakes are high: with economic challenges looming, including inflation concerns and a potential trade war, Bessent’s role will be pivotal. While Wall Street remains optimistic, Americans on Main Street may remain skeptical of whether a billionaire hedge fund manager will prioritize their needs. Whether Bessent emerges as a stabilizing force or a polarizing figure depends largely on how well he aligns with Trump’s economic philosophy.

Do you think Scott Bessent’s appointment as Treasury Secretary is a good choice for business? Tell us what you think about the latest additions to the Trump cabinet!