Uncategorized

Trump’s Tax Promises and Their Business Implications: Opportunity or Risk?

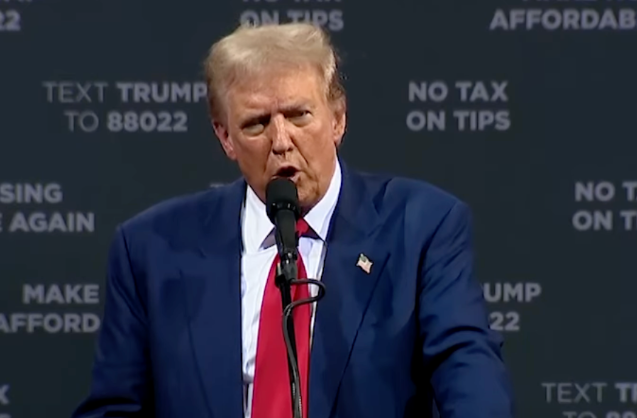

Source: YouTube

President Donald Trump’s recent meeting with House Republican leaders laid out a bold tax agenda. While many see these proposals as a win for working-class Americans, business owners and investors might want to take a closer look. Trump's tax promises include extending the 2017 Tax Cuts and Jobs Act (TCJA), adjusting the SALT deduction cap, eliminating the carried interest loophole, and instituting tax cuts for “Made in America” products. But what are the business implications of Trump’s tax promises?

Extending the 2017 Tax Cuts and Adjusting SALT Deductions

The 2017 TCJA was a significant win for businesses, slashing corporate tax rates from 35% to 21%. Trump’s push to make these cuts permanent offers continued relief for corporations and pass-through entities. This move could fuel further business growth, boost stock market performance, and enhance investor confidence. However, critics argue that extending these cuts may contribute to rising national debt and potentially affect long-term economic stability—key business implications that investors must consider.

Trump’s plan to adjust the State and Local Tax (SALT) deduction cap is particularly relevant for business owners in high-tax states like New York and California. Under current law, the SALT deduction is capped at $10,000, limiting the amount taxpayers can deduct from their federal returns for state and local taxes paid. By increasing or removing this cap, business owners and high-earning individuals in these states could see significant tax relief, freeing up capital for reinvestment in their businesses or properties. However, this proposal could face opposition from lawmakers in lower-tax states, who argue that it disproportionately benefits wealthier states and individuals. For investors, changes to the SALT deduction could impact regional property markets and influence decisions about where to allocate resources—critical business implications to keep in mind.

Tax Changes Affecting High-Income Earners

Trump aims to eliminate the carried interest tax deduction loophole and tax breaks for billionaire sports team owners. The carried interest loophole has long benefited private equity and hedge fund managers by allowing them to pay lower capital gains taxes instead of higher ordinary income rates. Closing this loophole could increase tax liabilities for high-net-worth investors and financial professionals.

While these changes promote tax fairness, they might deter investment in private equity and hedge funds. Investors should consider how this shift could impact their portfolios. Eliminating tax breaks for sports team owners may also affect franchise valuations and related investments. The business implications of these changes could alter the financial landscape for top earners and industry leaders.

Tax Incentives for Domestic Production

Trump’s proposal to institute tax cuts for domestically manufactured products could stimulate American industries and create new investment opportunities. Businesses producing goods in the U.S. would benefit from lower tax rates, potentially leading to job creation and increased profitability. For investors, this could mean higher returns in sectors like manufacturing, technology, and energy.

However, defining “Made in America” products and ensuring compliance could introduce regulatory complexities. Additionally, these tax cuts might provoke trade tensions, affecting companies with international supply chains or export markets. The business implications of such trade dynamics are essential for global investors to consider.

Balancing Business Benefits with Fiscal Challenges

While Trump’s tax promises offer significant benefits, they also come with potential drawbacks. Eliminating taxes on overtime pay and tips may increase disposable income for workers but could lead to higher wage expectations and labor costs for businesses. Moreover, the cumulative effect of these tax cuts might contribute to the national deficit, raising concerns about future fiscal policy shifts that could affect interest rates and investment climates. The broader business implications of these policies could influence long-term growth strategies for companies and investors alike.

What Do Trump's Tax Promises Mean for Your Business?

Trump’s tax promises present both opportunities and challenges for business owners and investors. While extending the TCJA and promoting domestic manufacturing could spur growth, measures like closing the carried interest loophole may affect high-net-worth individuals and financial professionals. Understanding the business implications of these proposals is essential for making informed business and investment decisions.

Which of Trump's tax promises will most impact your business? Let us know what you think!