Business

Americans Will See ‘Thinner Wallets And Anemic Economic Growth’ Under Biden

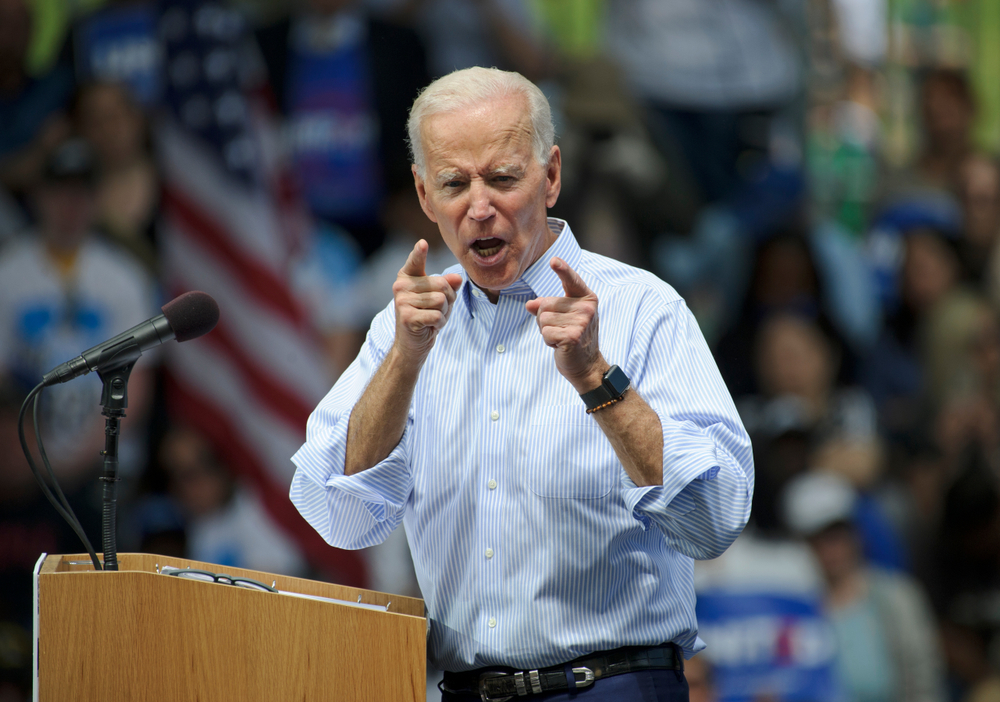

In a recent article for Fox Business, Alfredo Ortiz, the President and CEO of the Job Creators Network, says a Joe Biden presidency would leave all Americans with thinner wallets. However, his presidency would also be particularly painful for small businesses.

Overall, we can expect “thinner wallets and anemic economic growth,” according to Ortiz. He adds that this may come “as more tax liabilities are shoveled onto individuals and small businesses.”

Undoing a Helpful Act?

Biden’s top priority, according to Ortiz, will be to undo much of the 2017 Tax Cuts and Jobs Act. This said act helped create the strongest economy in the last 50 years.

“The number one priority on Biden’s fiscal to-do list is to walk back key provisions of the 2017 Tax Cuts and Job Act,” Ortiz said. It “lowered tax rates for individuals and small businesses according to him. Ortiz also mentioned that it helped “ignite the strongest economy in half a century.”

This will include raising the income tax rates for both individuals and for corporations.

“Among the changes, Biden supports increasing the top income tax rate by seven percent — which is commonly applied to pass-through small businesses — and raising the corporate tax rate by a third.”

Burden on Small Businesses

This tax increase for small businesses will be particularly burdensome, says Ortiz.

“Small business entrepreneurs — who are responsible for two-thirds of all new job creation and employ 60 million Americans — would be forced to shell out more money to Uncle Sam, which would otherwise be set aside for payroll costs, overhead expenses and investment.

“When taking into account state and local taxes, some small businesses could be paying up-to a 50 percent marginal tax rate.”

He says this will be more devastating on small businesses than economic lockdown brought on by the coronavirus pandemic. It will also cause corporations to begin looking elsewhere to produce their goods. This may inevitably happen as the higher tax rates will make doing business in the US too costly.

“Companies that have flocked back to the U.S. to build factories and help restore America’s manufacturing sector will once again be gutted by corporate tax rates that are among the highest of our economic competitors—notably China.”

New Taxes

The laundry list of new or increased taxes will help the government collect nearly $4 trillion in new taxes. Ortiz says this will happen over the next 10 years.

“Other new taxes include a jump in capital gains tax rates, a lower limit on assets parents can leave to their children without being hit with the death tax and inflated Social Security payroll taxes for some individuals and businesses.

“According to the Tax Foundation, together, these changes would amount to $3.8 trillion in new taxes paid to the government over the next decade.”

Ortiz also says even that amount won’t begin to cover the bill for Biden’s expensive ventures. These include his foray into climate change and socialized healthcare.

“Biden’s public option health care proposal, for example — or as I call it, a pit-stop on the way to an even more expensive “Medicare-for-all” framework — would cost taxpayers $750 billion over the next decade. And his plan to tackle climate change has a $2 trillion price tag over the next four years.”

The Choice Is Clear

Ortiz says a second term for President Trump means a lower capital gains tax. It cuts or eliminates payroll taxes, and it also allows working Americans to keep more of their paycheck.

The choice is clear to Ortiz.

“Allowing working Americans to keep more of their own paycheck and curbing the double taxation ploy applied to money earned in the stock market is just what the doctor ordered to help shore-up the American economy and recover from pandemic lockdowns.

“The fiscal policy differences between Trump and Biden couldn’t be more stark. Your wallet and the survival of America’s job creators are on the ballot this November.”

Up Next: