|

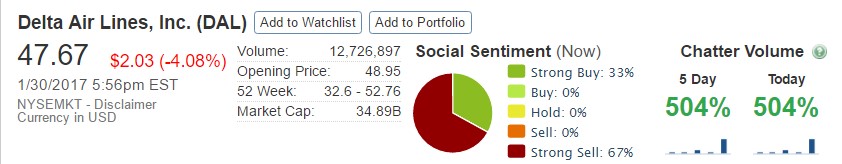

On Friday, President Donald Trump signed an executive order halting refugee access for 120 days. He also halted travel from seven predominantly Muslim countries. As a result, protesters mobbed airports around the country, causing chaos for travellers. And while those actions certainly took a toll on airport congestion, there appears to be another culprit equally involved; Delta Airlines. What’s going on at Delta? Should shareholders be worried?

Read The Capitalist’s Take Here

Read More at CNBC

Read More at Wall Street Journal

TRUMP SIGNS EXECUTIVE ORDER AIMING TO SLASH FEDERAL REGULATIONS

President Donald Trump signed an order on Monday that will seek to dramatically pare back federal regulations by requiring agencies to cut two existing regulations for every new rule introduced. “This will be the biggest such act that our country has ever seen. There will be regulation, there will be control, but it will be normalized control,” Trump said as he signed the order in the Oval Office, surrounded by a group of small business owners. Trump's latest executive action will prepare a process for the White House to set an annual cap on the cost of new regulations, a senior official told reporters ahead of the signing…

Read More at Yahoo News Here

Read More at Reuters Here

Read More at CNBC News Here

DESPITE EMISSIONS SCANDAL, VOLKSWAGEN OVERTAKES TOYOTA AS WORLD’S LARGEST AUTOMAKER

If you have been dying to find out whether Toyota defended its title of World’s Largest Automaker in 2016, or whether Volkswagen fulfilled its dream of becoming the world’s largest, you now have the official answer: This year, the World’s Largest Automaker is whichever of the two you want it to be. Volkswagen has beaten Toyota. Or maybe not….

Read More at Forbes Here

Read More at USA Today Here

Read More at MotorTrend Here

Closing Bell

– Monday, January 30th

Markets Crash Down as Trump’s Policies Concern Traders

Big Insider Trades

– Texas Instruments, Inc. (TXN) Senior VP Kevin Richie Sells $8.7m

– Alliance Data Systems, Corp. (ADS) Stakeholder ValueAct Holdings Buys Another $12.5m

|