Newsletters

The Capitalist Newsletter – November 18, 2016

WHY STEVEN MNUCHIN SHOULD BE DONALD TRUMP’S NEXT SECRETARY OF TREASURY |

|

Winners & Losers – Western Refining, Inc. (WNR) Shoots UP (23.11%) After Announcing Sale of Company to Tesoro for $4.1 Billion – DryShips, Inc. (DRYS) Plummets DOWN (90.43%) After Momentum Finally Runs Out

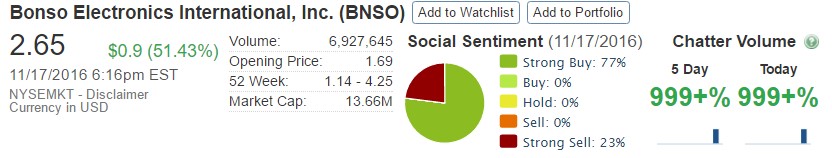

Most Talked About Bonso Electronics International, Inc. (BNSO) a Hot Topic and Strong Buy After Setting 52-Week High

The TIP Sheets – Thursday, November 17th – Valeant Pharmaceuticals International, Inc. (VRX) Ticks UP (0.67%) After Two Former Execs are Charged in Fraud and Kickback Scheme. The Company is Now in the Clear, and Shares Should Spike UP

Unusual Volume

– Best Buy Co., Inc. (BBY) Jumps UP (13.70%) on 25m Shares Traded After Setting Record High Share Prices and Receiving a Big Boost From Online Sales. With the Holidays Right Around the Corner, Look For Shares to Continue UP |