Newsletters

The Capitalist Newsletter – October 6, 2016

|

|

Winners & Losers -Cincinnati Bell (CBB) Skyrockets UP (384.28%) After Completing One-for-Five Reverse Stock Split – Immunomedics, Inc. (IMMU) Falls DOWN (15.10%) on Secondary Offering

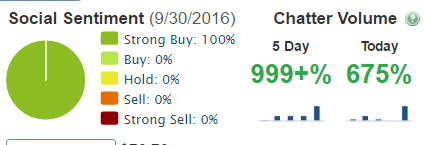

Most Talked About Global Payments Inc. (GPN) a Unanimous Strong Buy After Beating Quarterly Expectations; Declaring Quarterly Dividend

The TIP Sheets -Wednesday, October 5th -Japan’s Sompo to Buy Insurer Endurance Specialty Holdings, LTD. (ENH) for $6.3 Billion. Expect Shares to Spike UP

Unusual Volume

– Cousins Properties, Inc. (CUZ) Trades 55 Million Shares After Reports Company is Replacing Community Health in S&P 400 Midcap After Completion of Current Merger. Get in Early and Look For Shares to Jump UP

|