Taxes

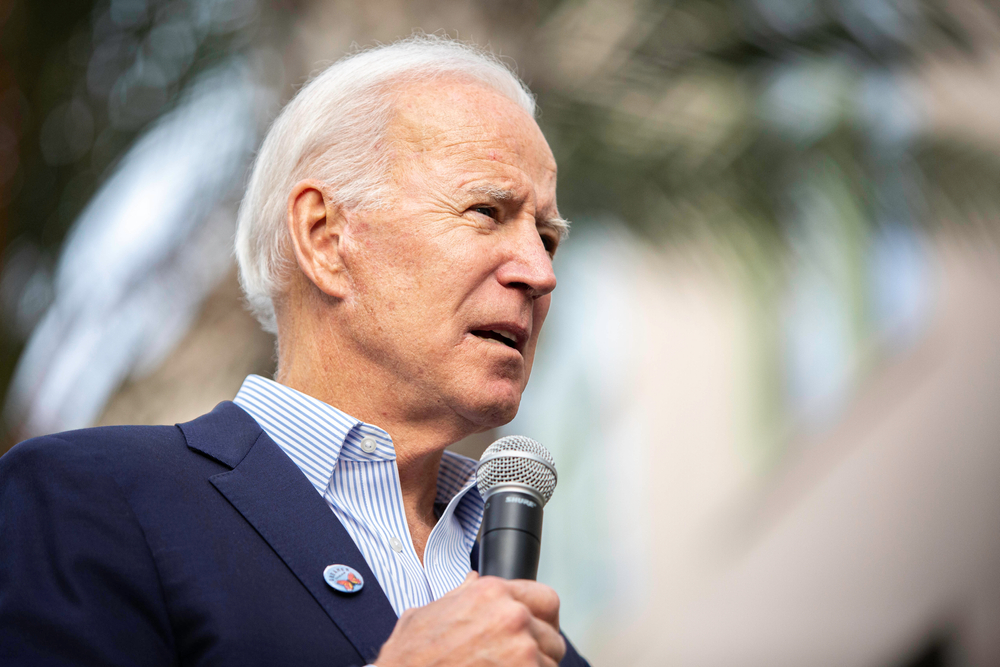

Joe Biden’s Tax Plan Takes Aim At High Earners And Corporations

With Joe Biden officially becoming the Democratic nominee for president, it’s time to look at his tax policy and how it could affect the country. As expected, high-income earners and corporations are in the cross-hairs.

Higher Taxes on Wealthier Americans

Thus far, Biden has not pushed for a “wealth tax.” But he has expressed the desire to raise taxes on the wealthy. For instance, he wants to raise the highest personal income rate back to 39.6% after it was lowered to 37% by President Trump’s 2017 tax reform law. Biden also wants to cap itemized deductions for wealthier Americans, place stricter limits on “like-kind exchanges” by real estate investors, and phase-out the 20% deduction for qualified business income for high-income individuals.

He’s also expressed an interest in eliminating the step-up in basis for inherited capital assets, which will result in higher taxes on wealth passed to heirs, and raising the capital gains tax for individuals making over $1 million.

As we covered here, Biden would also increase Social Security payroll tax. Currently the limit is $137,700 in wages and salary. Any income above that amount isn’t subject to the payroll tax. Biden wants to add the tax to those who make more than $400,000.

Tax Breaks for Ordinary Americans

Biden has said he would expand the child and dependent care credit to $8,000 per child (up to $16,000) while also making it refundable and payable in advance. He would also forgive student loan debt and make that exclude the forgiven debt from taxes.

Other proposals include expanding the work opportunity tax credit to include military spouses,

increase worker’s access to 401(k) plans and offer tax credits to small businesses that offer retirement plans for their workers.

Health Care

Biden has said he would eliminate the income-based cap on the premium tax credit so the credit is available to all families who purchase insurance through an exchange. He would also base the credit on the cost of a gold-level health plan instead of the cheaper silver-level plan.

He would also impose a tax penalty on pharmaceutical companies that increase drug costs by more than the rate of inflation and take away their deduction for advertising expenses.

Senior Citizens

Low-wage workers over 65 years of age would be eligible to claim the earned income tax credit (currently, you can't claim the credit if you're over 65).

Corporate Taxes

Biden has said he wants to raise the corporate income tax rate from the current 21% up to 28%. He also wants a minimum tax rate of 15% on large corporations.

He also supports a “claw-back” provision that would force companies to return public investments and tax benefits if they eliminate jobs in the U.S. and send them overseas.

As National Economic Council Director Larry Kudlow stated, Democrats can talk all they want about the wealthy paying higher taxes. In the end, it’s always the middle class that gets stuck paying higher taxes, and Biden’s promises are no different.