News

Latest Jobless Rate Totals 214,000, Lower Than Expected

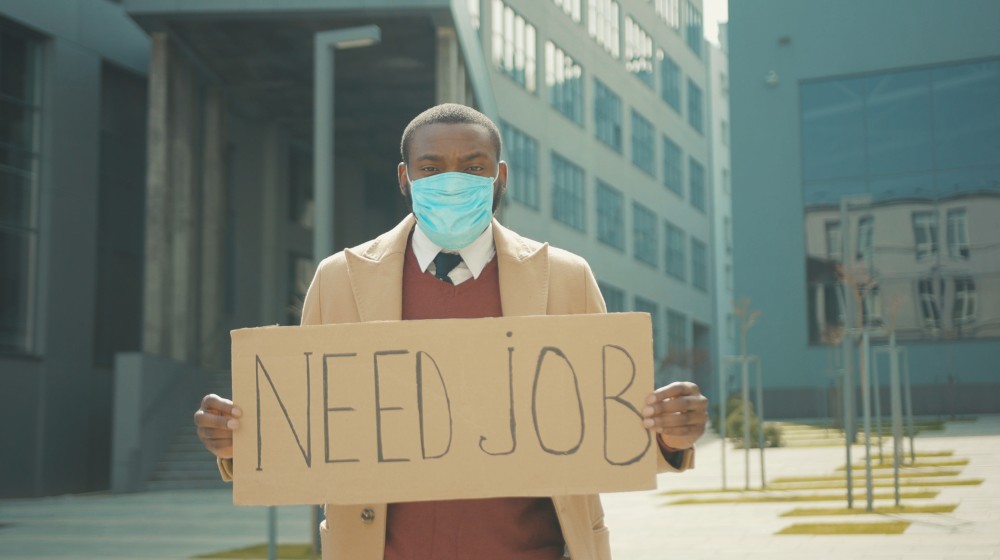

The Labor Department’s latest jobless rate shows a further tightening of the labor market. The latest jobless rate of 214,000 for the week ending March 12 represents the lowest numbers reported this year.

RELATED: Jobless Claims Lowest Since 1969 – Futures Slide Ahead of the Open

Latest Jobless Report Lists 214,000

According to the US Labor Department, the country’s latest jobless rate totaled 214,000. For the week ending March 12, the number of initial unemployment insurance filings was less than the projected 220,000.

The latest jobless rate also marked a decline of 15,000 from the previous week. This means that the US labor market is further tightening as more positions get filled up. Last week’s figures are the lowest recorded since the start of 2022.

Lowest Continuing Claims Since February 21, 1970

In addition, the four-week moving average also dropped considerably. It fell by 8,750 to 223,000. Meanwhile, continuing claims, which released its numbers behind the weekly jobless rate, fell by 71,000 to 1.42 million.

This is the lowest number of claims recorded since February 21, 1970. For the employment picture, the job situation remains complicated.

Despite the strong hiring activity over the last few months, more jobs remain open as they wait for applicants. In a tight labor market, jobs outpace the number of available workers.

This signals that the economy is nearing full employment. As a result, recruitment efforts become more difficult, placing pressure on hiring companies to offer higher wages.

Currently, jobs outnumber workers by 5 million. Not surprisingly, starting salaries are rising along with signing bonuses. In addition, inflation levels in the US are now at their highest levels since the early 1980s.

Labor Market ‘Tight To An Unhealthy Level’

On Wednesday, Federal Reserve Chairman Jerome Powell described the situation in the labor market as “tight to an unhealthy level”.

The US central bank recently implemented a quarter point increase in interest rates, it's first in more than three years. This is an initial move aimed to combat inflation by curbing spending.

For 2022, the Federal Reserve indicated plans to raise the interest rate six more times. The plan is to make interest rates reach 1.9% by the end of the year. Next year, the Fed foresees three additional rate hikes as well.

Manufacturing Activity Also High

Meanwhile, the Philadelphia Federal Reserve’s gauge of manufacturing activity in the region posted 27.4 in March. This is higher than the 15 economists predicted for the month.

Manufacturing activity numbers show the difference between firms looking at expansion versus companies seeking to downsize. The 27.4 numbers indicated the intense pressures companies are facing due to inflation.

Federal Reserve data also showed that production at US factories rose in February. The rise of 1.2% was by far the most in the last four months.

This means that supply chain issues and higher costs are still dictating the pace in the manufacturing sector.

However, the 1.2% reading followed a 0.1% gain in January. Total industrial production, including mining and utilities, rose 0.5% last month.

Watch the CNBC Television news video reporting that weekly jobless claims, housing starts to come in better than expected:

What do you think of the lower jobless rates recorded in the week ending March 12? With an available 5 million in the US labor pool, why aren’t more Americans looking for a job?

Tell us what you think about the tightening labor market. Share your comments below.