News

Senate Republicans Block Democrat Tax Bill, Scores Dems for Show Votes

Last Thursday, Senate Republicans successfully blocked a Democrat tax bill designed to temporarily expand the child tax credit and restore specific business tax benefits. The procedural vote ended with a 48-44 tally, falling short of the 60 votes required to advance the bill. This move is part of a broader political strategy by Democrats, who anticipated the bill's failure but aimed to spotlight the child tax credit ahead of the November elections.

Democrats Pushing Tax Bill to Score Political Points

The Democrat-led House passed the bill earlier this year, but it faced opposition in the Senate. Senate Republicans sought amendments to address various concerns, including the potential for the bill to disincentivize work and the possibility of undocumented immigrants claiming the credit. Despite these valid concerns,

Democrats pushed the vote, framing Republicans as obstructionists.

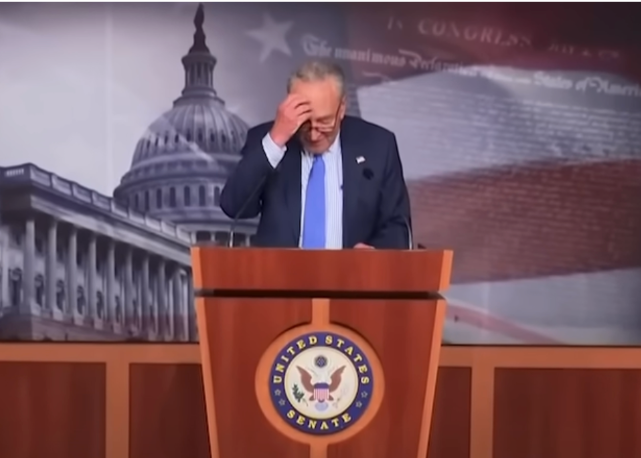

Senate Majority Leader Chuck Schumer criticized Republicans, including Senator JD Vance, for allegedly opposing the child tax credit. However, these accusations are misleading. Vice President Kamala Harris, a presumptive Democratic presidential nominee, has advocated for increasing the credit, contrary to Schumer's claims.

Key Amendments in the Democrat Tax Bill

The Democrat tax bill proposed several key changes:

Child Tax Credit Expansion: The bill aimed to provide a larger child tax credit for low-income families, affecting roughly 16 million children. It also included provisions to adjust the credit for inflation, potentially increasing the maximum credit to $2,100 per child by 2025.

Business Tax Benefits: The bill sought to restore tax benefits from the 2017 Tax Cuts and Jobs Act, including immediate deductions for research and investment costs, crucial for small businesses. These benefits would support business growth and economic stability.

Disaster Relief and Housing: Provisions for disaster relief and enhancing the low-income housing tax credit were also included, aiming to add more than 200,000 affordable housing units nationwide.

Republican Concerns and Actions

Republicans have expressed concerns that the bill would disincentivize work and allow undocumented immigrants to claim the credit. House Ways and Means Chairman Jason Smith emphasized that the bill maintained a minimum earnings threshold and required Social Security numbers for children to claim the credit.

If passed, the bill would have lifted half a million children out of poverty and improved the financial situation for millions more. It would also have provided significant tax benefits for small businesses, enabling them to deduct costs immediately and invest in growth. However, Republicans argue that more thoughtful legislation is needed to avoid unintended consequences. The economic implications of restoring business tax benefits are significant. Allowing immediate deductions for research and investment costs would encourage innovation and job creation. Small businesses, which are the backbone of the American economy, would particularly benefit from these provisions. The broader social impact includes enhanced support for disaster relief and affordable housing, which are critical issues for many Americans.

Republicans Score Democrats for Using the Tax Bill for Political Manuevering

The decision to block the Democrat tax bill comes in the context of intense political maneuvering ahead of the November elections. Both parties are positioning themselves on key issues to gain voter support. The outcome of this and similar votes could have significant implications for the political landscape and the policies that will be pursued in the future.

The Senate Republicans' decision to block the Democrat tax bill highlights the ongoing political maneuvering as both parties position themselves ahead of the elections. While the bill contained provisions that could benefit families and businesses, Republicans stress the need for balanced and responsible governance. As the political battle continues, it's crucial for voters to stay informed and engaged on these important issues.

Do you support the GOP’s decision to block the Democrat tax bill? What amendments do you want to see in a new tax bill?

Click here to subscribe to our newsletter and stay ahead of the curve!