Debt

A Trillion Here, a Trillion There

The national debt now stands at more than $28 trillion dollars. In 2000 it was $5.6 Tril dollars-that seems like such a quaint amount now. Did America have a choice?

The attacks of Sept. 11 and subsequent homeland security expenses coupled with the Great Recession of 2008 and the COVID pandemic caused the federal budget to balloon, adding trillions of dollars a year to the debt.

RELATED: House Passes Bill To Suspend Debt Limit, Avert Shutdown

A Trillion Here, a Trillion There

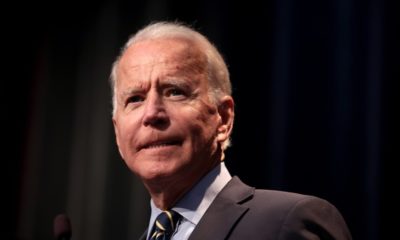

President Biden is working hard to get his $3.5 trillion spending plan approved. He is not only facing opposition from Republicans. With razor-thin margins in both the U.S. House and the Senate, the President cannot afford to lose one single vote.

The president has met with two Democratic senators who will not vote for the $3.5 Tril plan. One can only imagine conversations between those senators and the President. What concessions are demanded or offered to secure those necessary votes?

We've been here before in negotiations over the raising of the debt ceiling. Every time, those who oppose it get something in return for their support. It is always a game of political chicken.

This go-round, some smell blood in the water, and feel they can be victorious, get what they want and position themselves to win big in the mid-term elections next year.

National debt of $5 trillion is manageable and with fiscal responsibility payments on the debt can be slowly paid down. A $30 trillion debt is different and we are at a point where we could all suffer economic pain.

Spending $3.5 Tril the government doesn't have will not endear the President or Congress to the people. Only maintaining the country and safeguarding our economy will do that. Can't we get by with $1.5 Tril?

A trillion here, a trillion there adds up to real money. Stop playing political chicken and don't mortgage the future of our grandchildren and their children for a short-term gain.

You Might Also Like:

- Facebook Shares Value Fell By $47B After Server Outage

- Fed Officials to Face Probe for Possible Insider Trading

- Treasury Gives More Investment Freedom

Keep up to date with the latest finance news by following us on Facebook and Instagram.

Article Source: NewsEdge