Business

Why an American Tech Company Should Buy TikTok

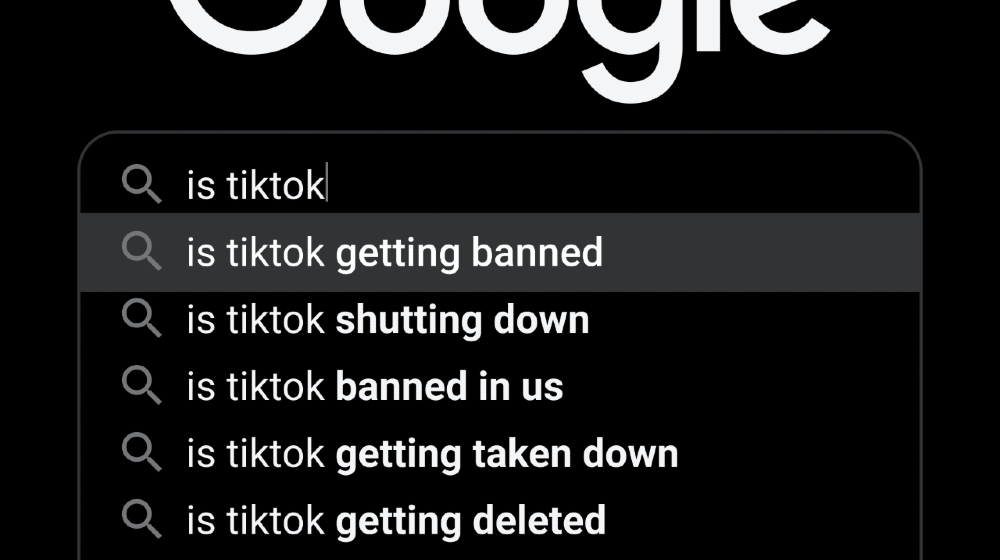

American Tech companies should buy TikTok. The countdown to the September 15 deadline is nearing. Social media app TikTok has less than a month to get an American tech company to save its US operations. And there is no shortage of buyers. Google, Facebook, and even Twitter have shown interest earlier. President Donald Trump even endorsed Oracle as a potential buyer. At present, there is a buzz that Microsoft is nearing a buyout. But what is TikTok? And why does it need an American company to buy its operations?

RELATED: TikTok Picks Oracle As US Partner

Why is America worried about TikTok?

TikTok is a popular social media app that took China by storm in 2016, and the rest of the world by 2018. The app itself seems harmless as it promotes self-expression. Users record a few seconds' clips of themselves singing, dancing, or any other activity. Afterward, they can upload the video to share with others. The popularity of the app skyrocketed when celebrities began using it for promotion. Using artificial intelligence, TikTok analyzes user interests via reactions and provides personalized content.

With its active data gathering, US officials have shown concern over data collection. More specifically, the government worries where the data will end up. ByteDance, which owns the app, is a Chinese company with headquarters in the mainland. Officials worry that TikTok can share the data of 100 million American users to Beijing.

The Wall Street Journal reported that the app might be skirting privacy laws by collecting MAC addresses. TikTok has said they have ended that practice.

China is also notorious for monitoring and censoring internet content within its borders. There is concern that similar policies might find their way here, as well as propaganda.

Citing these concerns, President Trump threatened to ban TikTok in the United States. Unless ByteDance agrees to sell its US operations to a US tech company, the ban will start on September 15.

High Tech Suitors

Microsoft immediately offered to buy TikTok's US, Canada, Australia, and New Zealand operations. For the software giant, this could mean becoming a major player in the social media arena. This also makes the lucrative digital ad business available to Microsoft. At present, Google, Facebook, and Amazon share 70% of the business.

Trump earlier dismissed Microsoft as a buyer, but later warmed up to the idea if a complete deal happens in 45 days.

Other companies who showed interest in acquiring TikTok include Twitter and Oracle. Trump even endorsed an Oracle buyout of Twitter earlier this month.

“A Threat to American Tech”

ByteDance founder Zhang Yiming supported the sale of some of TikTok's offshore operations. In a letter to the ByteDance staff, he said that “As a company, we have to abide by the laws of the markets where we operate.” It feels like the goal was not necessarily a forced sale, but given the current macro situation, a ban, or even more.”

Meanwhile, China did not take kindly the pressure to sell off ByteDance or its operations. Chinese state media stated that such pressure amounts to “theft”. Zhang himself got branded as a “traitor.” The Global Times accused the US of “killing China’s most competitive companies.” It also said that the US is doing so out of cowardice, as TikTok poses a threat to American tech companies. China Daily likened the order as “tantamount to inviting potential U.S. purchasers to participate in an officially sanctioned ‘steal’ of Chinese technology.”

In a recent development, TikTok sued the government last Monday. The suit challenges the Trump order to sell US operations to an American buyer. TikTok claims it already protects its users' data, especially US user data. The company also insisted that it presented security measures to the federal government. The complaint stated: “By banning TikTok with no notice or opportunity to be heard (whether before or after the fact), the executive order violates the due process protections of the Fifth Amendment.” It asked the court to invalidate the president's order. Both the White House and the Justice Department have yet to comment.

With about 20 days remaining, the suit may have bought TikTok more time. Although, Microsoft has earlier said they will back out of any deals if nothing gets done by September 15.

To Sell or Not To Sell?

In a way, the sale of TikTok's US operations to a local company may be a better option than outright banning the app. TikTok will become subject to local laws, especially in data collection and security. The government will also get a definite answer on what data gets collected and where it goes. Analysts fear that it may be a precedent to a growing tech divide between China and the US. If this escalated further, the rest of the world may have to choose sides.

Watch this as White House economic advisor Larry Kudlow discusses the potential purchase of TikTok's U.S. operations by an American tech company such as Microsoft:

Do you use TikTok? Whether yes or no, would you prefer an American owned or managed company for an app that collects user data? Do you find all this too much, considering it's about a program that shows videos with short attention spans? Let us know what you think about this TikTok conundrum in the comments section below.