Business

Every Investor Must See This Chart

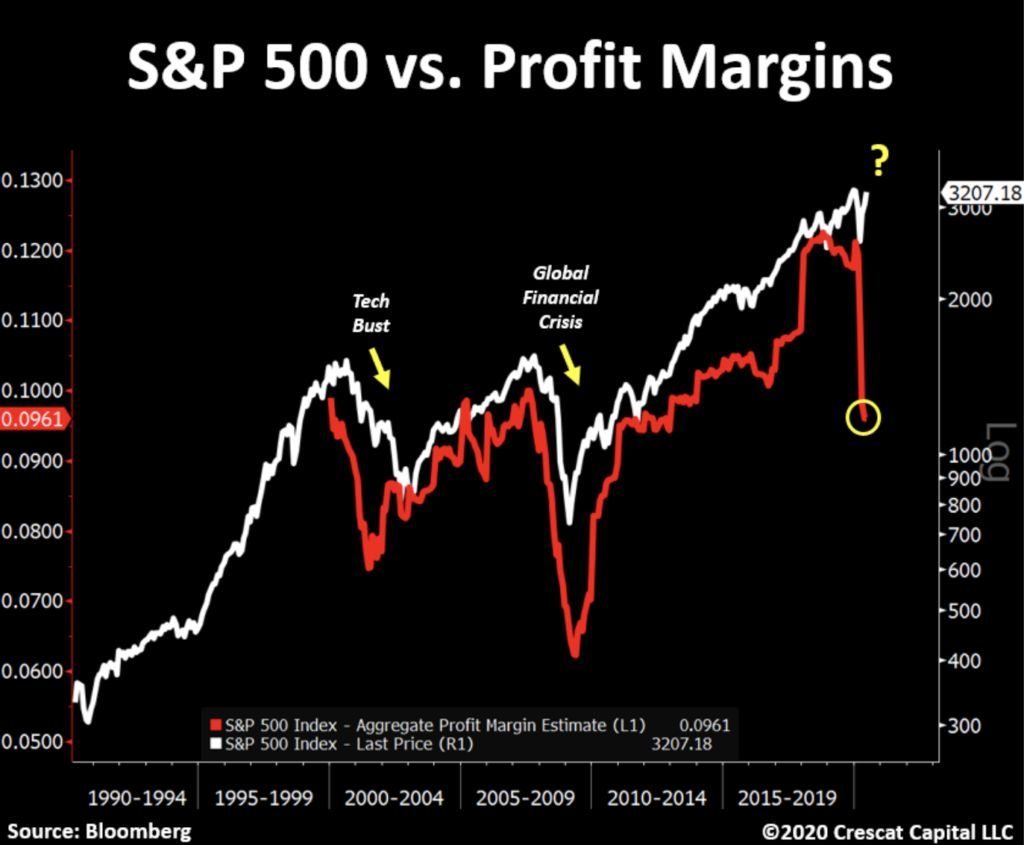

Kevin Smith, the founder and chief investment officer at Crescat Capital, recently published a chart regarding profit margins. This chart should have any investor nervously looking over their portfolio.

The chart, which compares the S&P 500 index to the index’s profit margins, shows two lines that are heading in completely opposite directions. The S&P 500 index is heading higher, while the profit margins of the companies that make up the index are on an elevator ride straight down.

For anyone who thinks the market has a connection with reality, this chart should quickly dispel them of that myth.

Smith says the chart, shown below, is “a great illustration of how insanely disconnected equity prices are from their underlying fundamentals. S&P 500 profit margin estimates are plunging! “Buy the dip” investors are not paying attention and have simply been too eager to call the bottom.”

Unsettling Figures

In his note to clients, Smith doesn’t pull any punches. He also makes it clear that he expects the market to plunge from here. He then says, “the potential reward-to-risk tradeoff from shorting stocks is worthy of a significant allocation today.”

“The US stock market is absurdly overvalued. In our analysis, the gap between current prices and discounted present value of likely future cash flows is the highest ever,” Smith notes. He also points out the effect stay-at-home day traders have had on the market.

“Speculation is rampant and being championed by a bold new breed of Millennial day-traders. The mania is based on a widespread hope in Fed money printing. The catalysts for reckoning are numerous as a major cyclical economic downturn has only just begun.”

Smith goes on to point out that the current euphoria in the market is nothing more than a response to money printing by the Federal Reserve. It's something that he points out never ends well.

“Markets driven by euphoria never end well. The US stock market today is in la-la land. It is discounting a new expansion phase of the economy at the same time as a major recession has only just begun. Since the March lows, investors have turned overwhelmingly bullish. They are trusting that central banks’ liquidity will miraculously create economic growth rather than just temporarily ease the pain of declining gross domestic incomes and crushing debt burdens.”

A Possible Recession?

He believes the Fed’s money printing will fail. He also thinks that our country will face a severe recession if not an outright depression.

“This delusional thinking is induced by the intense but short acting dopamine response to Fed money printing but completely ignores how business cycles work. Government money printing has failed miserably, repeatedly, throughout history at eliminating recessions and frequently coincides with some of the worst downturns. Today, it is a major symptom of a severe recession if not a depression.”

The markets can run on delusional thinking for only so long before reality sets in. To profit from the fall, Smith says to buy put options on the major stock indexes.

“At Crescat, we remain determined to capitalize on a US equity market downturn via short positions in our hedge fund strategies and believe there is much further downside for stocks at large ahead. Asset bubbles always burst. US stocks prices are way ahead of future fundamentals and poised to disappoint. Equity and credit markets are not immune from a business cycle downturn. They must eventually catch up to the abysmal fundamentals of today’s global economy that is in a severe recession.”

Up Next: