News

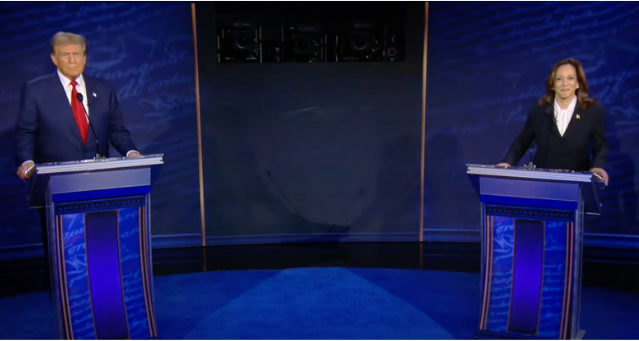

Market Reactions to the Trump-Harris Debate: What Investors Need to Know

The highly anticipated Trump-Harris debate last night left markets in a bit of a limbo. Both Wall Street stocks and Bitcoin experienced modest declines, reflecting the broader uncertainties surrounding the political landscape. But while tariffs took center stage during the debate, taxes—a key issue for many businesses—were left conspicuously absent. So, what are the market reactions, and what should investors watch out for?

Wall Street and Bitcoin: Mixed Reactions

While the Trump-Harris debate did little to sway the market in any major direction, some movements were noteworthy. Dow Jones futures dropped 0.3%, S&P 500 futures fell 0.4%, and Nasdaq 100 futures slid 0.45%, indicating a slight but tangible market dip. Bitcoin prices also followed suit, dipping after the debate, which aligns with the broader market sentiment of caution.

According to Marko Papic, chief strategist at BCA Research, the market was largely indifferent to the debate. The tight presidential race and lack of significant policy shifts make it challenging for investors to react. “It’s difficult for the market to price in any significant political changes,” Papic said, reflecting the broader sentiment that the debate was more of a status quo event.

No Mention of Taxes, But Tariffs Took the Spotlight

For many in the business world, the lack of discussion on taxes was the elephant in the room. Trump has long advocated for cutting corporate taxes, a move that would likely boost stock prices and stimulate investment. In contrast, Harris has called for raising corporate taxes and implementing higher capital gains taxes, which would be less favorable to market growth. However, neither candidate ventured far into the topic last night.

Instead, tariffs became a key focus, with Trump doubling down on his promise to impose higher tariffs on Chinese goods and electric vehicles manufactured in Mexico. Harris criticized this approach, arguing that it hurt American manufacturing and would continue to do so under Trump’s policies. For investors, the debate on tariffs adds another layer of uncertainty, particularly for those in industries like tech and manufacturing that are heavily reliant on global supply chains.

What Investors Expect From a GOP or Democrat Win

Conservative investors remain divided over what the future holds depending on the outcome of the election. If Trump were to win, businesses are looking forward to tax cuts, deregulation, and continued policies that foster free market growth. Many in the business world see his tax cut proposals as a key driver for economic expansion. However, they also fear that his aggressive tariff strategies could lead to escalating trade wars, which would negatively affect companies dependent on international supply chains.

In contrast, a Democratic victory, led by Harris, brings concerns of higher corporate taxes and increased regulation, especially in energy and tech sectors. Investors worry that Harris’s plan to raise the corporate tax rate to 28% and increase capital gains taxes would shrink profits and reduce incentives for investment. On the regulatory front, businesses fear that a Democratic administration might impose stricter environmental and labor laws, which could burden U.S. companies and hinder growth. Despite these concerns, some conservative capitalists remain optimistic that certain Democratic policies, like investments in clean energy and infrastructure, could open up new opportunities for businesses in emerging sectors.

Who Should Investors Root For?

With no clear winner emerging from last night’s Trump-Harris debate, the market reaction has been muted. Taxes remain a major unanswered question, while tariffs continue to be a contentious issue. As the election draws nearer, investors will be watching closely for any signs of a shift in policy that could impact their portfolios. For now, conservative capitalists remain focused on policies that promote growth and minimize government interference in the marketplace.

Who do you think won last night’s Trump-Harris debate? Should business brace themselves for the effects of a win from either party? Tell us what you think.

1 Comment

A weak debate by both parties.