Business

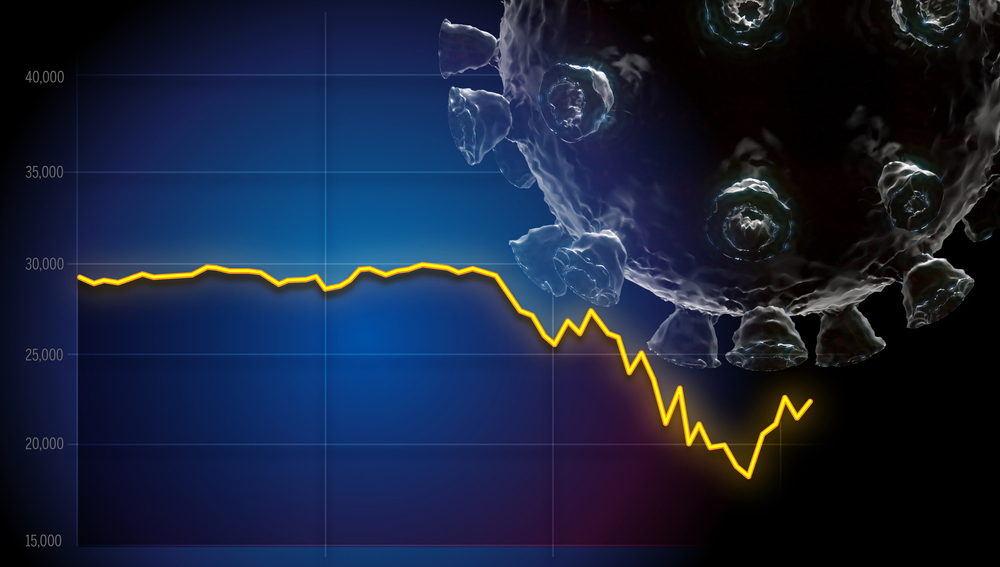

Stock Market ‘Running Off A Cliff Like Wile E. Coyote’

If you want to know how James Montier feels about the stock market, look no further than the title of his recent research paper, Reasons (not) to be cheerful: Certainty, Absurdity, and Fallacious Narratives.

Montier, a behavioral economist and member of the asset allocation team at Jeremy Grantham’s GMO, believes stock market investors are far too confident in the face of uncertainty.

“It is as if Mr. Market is taking a tail risk (albeit a good one) and pricing it with certainty,” said Montier, adding, “Never before have I seen a market so highly valued in the face of overwhelming uncertainty.”

Referencing Voltaire’s character in Candide, Montier says “It appears as though the U.S. stock market has drunk from Dr. Pangloss’ Kool-Aid – where everything is for the best in the best of all possible worlds.”

Stock Market Running like “Wile E. Coyote”

He questions how the stock market, if it is a forward-looking device, can recover so quickly from the March lows. Montier asks this when there haven’t been any positive catalysts other than government stimulus bills.

He says “The U.S. stock market looks increasingly like the hapless Wile E. Coyote, running off the edge of a cliff in pursuit of the pesky Roadrunner but not yet realizing the ground beneath his feet had run out some time ago.”

The Dow Jones Industrial Average is now just 5.5% below its all-time high from February 12, the S&P 500 has flirted with a close above its previous all-time high, and the Nasdaq has posted 32 new record highs this year.

Yet unemployment rates are still incredibly high. Also, there’s no vaccine yet against the coronavirus and the latest stimulus bill has stalled in the Senate.

“It is certainly true in theory that the stock market is meant to be a forward-looking device, capable of seeing through short-term issues,” Montier notes. “History teaches us that the market is usually a master of double-counting,” says Montier. He also mentions that it attaches “peak multiples to peak earnings, and trough multiples to trough earnings.”

Recovery Similar to the Great Financial Crisis

He adds that the only historical comparison for the “v-shaped” recovery we are experiencing is the Great Financial Crisis. Also, he says even that falls well short of the rapid recovery we have seen.

In only 102 trading days, the S&P 500 has regained nearly all of its losses from the March lows. If it can move into positive territory and regain its previous highs, it will be the fastest bear market recovery in history.

The current record is 310 trading days from Feb. 9, 1966 to May 4, 1967. The uncertainties that Montier says investors are all too willing to overlook. These include a failure to pass another stimulus bill, further US-China saber-rattling, and a virus resurgence this fall and winter.

Montier offers this outlook: “Rather than acting as if the uncertainty doesn’t exist (the current fad), the value investor embraces it and demands a margin of safety to reflect the unknown.”

Up Next: