bank

10 Countries With The Biggest Gold Reserves

According to the World Gold Council (WGC), 2015's second half was responsible for the most vigorous purchasing of gold on record.

The combined tons added last year totaled 483 tons globally.

China and Russia were noted to be the most active buyers.

This activity resulted in the second largest yearly amount seen since the 1930s.

As of 2010, a global change began taking place.

Central banks became net buyers of gold rather than net sellers of gold.

The graph below shows this:

The buying does not mean that all top banks have turned to net buyers.

The Bank of Canada, for example, has already liquidated almost all its gold.

The liquidation was accomplished through coin sales.

Venezuela is following close behind to settle national debts.

The majority of central banks worldwide are currently repatriating and accumulating gold.

According to the World Gold Council, 17.8 % of all of the precious metal ever mined is now owned by the combined world central banks.

They are reported to own 32,754 tons as of this month.

Quick schemes for printing money, bond-buying programs, and almost zero interest rates or even interest rates in the negative are on the rise adding to the unconventional monetary policies.

These systems have become more notable since the financial crisis.

The gold-buying trend seems to go along perfectly with this.

It is still unknown if this has been successful or not.

It does seem as though banks are working against policies they set in place, though.

Confidence in the central banks' capabilities to stop further economic decrease is steadily deflating.

[ms_divider style=”normal” align=”left” width=”100%” margin_top=”30″ margin_bottom=”30″ border_size=”5″ border_color=”#f2f2f2″ icon=”” class=”” id=””][/ms_divider]

[ms_featurebox style=”4″ title_font_size=”18″ title_color=”#2b2b2b” icon_circle=”no” icon_size=”46″ title=”Recommended Link” icon=”” alignment=”left” icon_animation_type=”” icon_color=”” icon_background_color=”” icon_border_color=”” icon_border_width=”0″ flip_icon=”none” spinning_icon=”no” icon_image=”” icon_image_width=”0″ icon_image_height=”” link_url=”https://offers.thecapitalist.com/p/58-billion-stock-steal/index” link_target=”_blank” link_text=”Click Here To Find Out What It Is…” link_color=”#4885bf” content_color=”” content_box_background_color=”” class=”” id=””]This one stock is quietly earning 100s of percent in the gold bull market. It's already up 294% [/ms_featurebox]

[ms_divider style=”normal” align=”left” width=”100%” margin_top=”30″ margin_bottom=”30″ border_size=”5″ border_color=”#f2f2f2″ icon=”” class=”” id=””][/ms_divider]

When it comes to gold reserves, these countries are the top 10:

10. India

- Foreign Gold Reserves equate to 6.3 %

- Tons: 55.7

India, located in South Asia, has a population of 1.25 billion citizens.

Depending on your source, this country is the largest or second-largest consumer of the metal.

It is a staple when driving up the global demand.

October through December marks a season of weddings and festivals in India.

During these months, India significantly increases the metal's Love Trade.

9. Netherlands

- Foreign Gold Reserves equate to 61.2 %

- Tons: 612.5

The Dutch Central Bank vault is currently under renovations.

The bank is actively seeking a secure place suitable to store the gold.

People are pointing out the oddity of the situation.

The bank repatriated 122.5 Tons from the United States in 2014.

8. Japan

- Foreign Gold Reserves equate to 2.4 %

- Tons: 765.2

Japan weighs in at the 8th largest reserve of gold.

8th place is not a wonder since Japan is the third largest economy in the world.

Japan's central bank is one of the most actively aggressive practitioners.

The decreased interest rates to below zero in January mainly helped worldly increase for the demand of gold.

7. Switzerland

- Foreign Gold Reserves equate to 6.7 %

- Tonnes: 1,040

Though Switzerland comes in 7th, it is the largest reserve worldwide per capita for gold.

When the country remained neutral throughout World War II, they became the European center for gold trade, and that ensured Axis and Allies powers alike made transactions.

Switzerland's main source of gold trading today is China and Hong Kong.

Last quarter the country's National Bank showed $5.9 billion in profit.

The profit is mainly due to its large holdings of gold.

6. Russia

- Foreign Gold Reserves equate to 15 %

- Tonnes: 1,460.4

Russia became the top gold buyer in 2015.

During this year, they added 206 tons.

Russia's top position in buying Gold was all done to separate itself from the American Dollar.

A chilly relationship between Russia and the West has resulted from the annexation of Crimean Peninsula.

Russia sold a significant percentage of its United States Treasuries in 2014 to raise cash for the purchases.

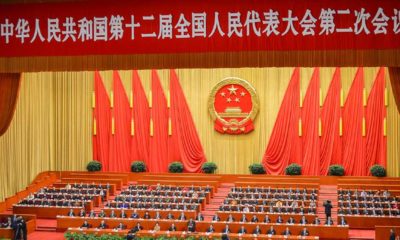

5. China

- Foreign Gold Reserves equate to 2.2 %

- Tonnes: 1,797.5

The People's Bank of China has begun sharing a monthly report showing the activity of gold purchasing as of summer of 2015.

The report is the first period the bank has done so since 2009.

December saw the renminbi become accepted as an International Monetary Fund reserve currency.

Other currencies included in the reserve are:

- Euro

- Dollar

- Pound

- Yen

China introduced a renminbi standard gold fix in April.

The fix was on its journey for greater power over pricing.

4. France

- Foreign Gold Reserves equate to 62.9 %

- Tonnes: 2,435.7

The central bank of France has sold minimal amounts of gold within the past years.

Some are calling for the sales of gold to stop entirely.

President of France's National Front Party, Marien Le Pen is leading this idea.

Not only would they like to see a stop to the sale, but repatriate the amounts in foreign vaults in their entirety.

3. Italy

- Foreign Gold Reserves equate to 68 %

- Tonnes: 2,451.8

Mario Draghi, European Central Bank President, supports Italy in their decision to maintain their reserve size.

In 2013 a reporter asked the former Bank of Italy governor what role gold held in the central bank portfolio.

He stated the precious metal is a reserve of safety.

He additionally stated it provides protections against fluctuations of the dollar.

2. Germany

- Foreign Gold Reserves equate to 68.9 %

- Tons: 3,381

Germany is following in the footsteps of the Netherlands.

The country has begun repatriating gold from their foreign locations.

It most notable recently repatriated its gold from Paris and New York.

The country transferred 210 tons within the last year and had futures plans set to transfer the total 3.381 tons to be transferred back to Germany by 2020.

1. United States

- Foreign Gold Reserves equate to 74.9 %

- Tonnes: 8,133.5

The United States holds almost the same amount of gold as the last three countries together.

It sits second globally in allocations of gold as a percent of foreign reserves to Tajikistan.

The metal takes over 88 % of the country's trade.

The graph below lays out the gold trade in the United States:

It is evident that a majority of the United States gold is currently in Kentucky within Fort Knox.

The remainder takes place at Denver Mint, West Point Bullion Depository, Philadelphia Mint, and San Francisco Assay Office.