Newsletters

The Capitalist Newsletter – February 3, 2017

GOOGLE AND SALESFORCE.COM; COULD A DEAL BE IN THE WORKS? |

|

Winners & Losers – Naked Brand Group, Inc. (NAKD) Rockets UP (137.61%) After Successfully Launching “Comfortably You” Sleepwear Collection – Shutterfly, Inc. (SFLY) Slumps DOWN (15.59%) After Dismal Q4 Earnings

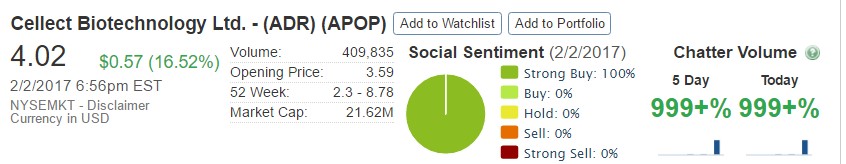

Most Talked About Cellect Biotechnology Ltd. (APOP) a Unanimous Strong Buy After Naming New Chief Development Officer

The TIP Sheets – Thursday, February 2nd – Ralph Lauren Corp. (RL) Tumbles DOWN (12.32%) After CEO Resigns Amid Differences with Company Founder. Expect Shares to Continue DOWN.

Unusual Volume

– Nokia Corporation (NOK) Pops UP (5.47%) on 44.5m Shares Traded After Beating Wall Street on Fourth Quarter Earnings. The Company Saw Sales Double in Wake of Recent Acquisition. Expect Shares to Continue UP |