|

President Donald Trump wasted no time in taking action and following up on his campaign promises. On Monday, our 45th president signed 3 executive actions, the first of which unravels former President Barack Obama’s signature trade agreement before it ever went into action. With the Trans-Pacific Partnership deal, what comes next?

Read The Capitalist’s Take Here

Read More at Reuters

Read More at CNN

JUDGE BLOCKS AETNA-HUMANA MERGER ON ANTITRUST GROUNDS

A federal judge Monday blocked the proposed merger of health insurers Aetna Inc. and Humana Inc. on antitrust grounds, a potentially fatal blow to the $34 billion deal and a capstone victory for Justice Department antitrust officials under former President Barack Obama. U.S. District Judge John D. Bates ruled the Justice Department had proven its case that the merger would unlawfully threaten competition. harming seniors who buy private Medicare coverage as well as some consumers who purchase health plans through an Affordable Care Act insurance exchange…

Read More at Wall Street Journal Here

Read More at Reuters Here

Read More at USA Today Here

WAL-MART TO SELL CARS VIA PARTNERSHIPS

Consumers are completing more and more of the car buying process outside the dealership, and now Walmart is throwing its hat into the ring. The nation’s largest retailer has partnered with dealership groups to sell cars through a new program launching April 1. Through the CarSaver program, buyers can select their desired new or used vehicle and apply for financing and insurance. Walmart will host CarSaver kiosks inside 25 of its Supercenters at launch, although customers can also go through the process on their own online or by calling an 800 number. After this initial stage, CarSaver links the customer to a local dealership so they can complete the transaction.

Read More at MotorTrend Here

Read More at Autoblog Here

Read More at Ad Age Here

Closing Bell

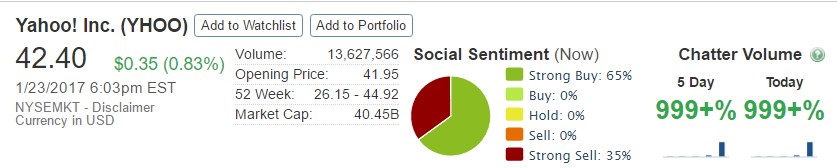

– Monday, January 23rd

Markets Dip Lower as Investors Wait to See What Trump Does

Big Insider Trades

– The Boston Beer Company, Inc. (SAM) President Martin Roper Sells $1.5m

– Denali Holding, Inc. (DVMT) CEO Michael Dell Buys $425k

|