Newsletters

The Capitalist Newsletter – November 11, 2016

TRUMP PROMISES JOBS FOR AMERICANS; BUT WITH THAT… INFLATION |

|

Winners & Losers – DryShips, Inc. (DRYS) Rockets UP (133.33%) After Q3 Results Show Company Slashed Losses – Monster Beverage Corp. (MNST) Tumbles DOWN (68.07%) After Additional Shares From 3-for-1 Split Distributed

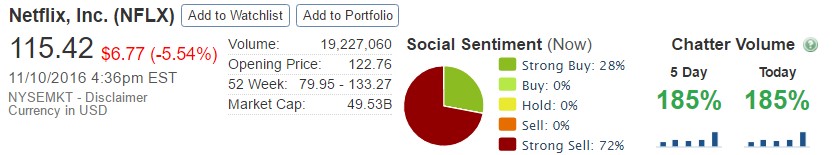

Most Talked About Netflix, Inc. (NFLX) a Consensus Strong Sell After Tech Falls Again Following Worries of International Dealings with Trump in Office

The TIP Sheets – Thursday, November 10th – TubeMogul, Inc. (TUBE) Spikes UP 81.75% After Announcing the Ad Tech Company is Being Acquired by Adobe for $540m. Expect Shares to Continue UP

Unusual Volume

– Fiat Chrysler Auto (FCAU) Sees Biggest Gain in Two Years, Jumps UP (9.68%) on 35.7m Shares Traded on Hopes That Trump May Weaken Fuel Economy Rule. If so, Look For Shares to Soar UP |