|

The Trans-Pacific Partnership (TPP) trade deal was a major step forward for Barack Obama’s administration in offsetting China's rising global economic and diplomatic influence. As with many Obama milestones, Donald Trump has sworn to repeal the current president’s actions. However, unlike the Affordable Care Act, Trump has now reaffirmed his commitment to withdrawing the U.S. from the pending TPP deal. What exactly is the TPP? And what are the pros and cons of exiting the agreement?

Read The Capitalist’s Take Here

Read More at CNBC

Read More at The Hill

PRESIDIO LAUNCHING IPO; OFFERING COULD RAISE $3 BILLION

Presidio, a provider of information technology infrastructure services, filed plans for an initial public offering that could raise up to $400 million. In its S1 filing, Presidio said it looks to raise $100 million, but that is likely a placeholder for an IPO that could raise $400 million, estimates Renaissance Capital. The number of shares to be offered and the price range for the proposed offering have not yet been determined. By comparison, Acacia Communications (ACIA) and Twilio (TWLO), raised about $100 million and $150 million with their IPOs this year, but Japan messaging firm Line (LN) raised about $1 billion

Read More at Investor’s Business Daily Here

Read More at Fortune Here

Read More at Wall Street Journal Here

U.S. OIL RIG COUNT RISES FOR FOURTH STRAIGHT WEEK

The number of rigs drilling for oil in the U.S. rose by three in the past week to 474, according to oil-field services company Baker Hughes Inc. The U.S. oil-rig count is typically viewed as a proxy for activity in the sector. After peaking at 1,609 in October 2014, low oil prices put downward pressure on production and the rig count fell sharply. The oil-rig count generally has been rising since the beginning of summer.

Read More at Wall Street Journal Here

Read More at ABC Here

Read More at Business Insider Here

Closing Bell

– Wednesday, November 23rd

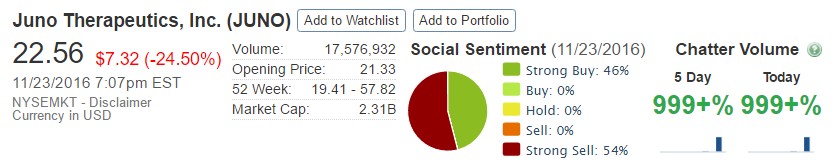

Dow, S&P Notch Third Straight Record Close Led by Industrials as Nasdaq Slips on Biotech

Big Insider Trades

– Netflix, Inc. (NFLX) CEO Reed Hastings Sells $8.8m

– Post Holdings, Inc.(POST) Director William Stiritz Buys $9m

|