Newsletters

The Capitalist Newsletter – October 13, 2016

SAMSUNG HAS NO IDEA WHAT’S WRONG WITH THE NOTE 7; HOW MUCH DOES APPLE BENEFIT? |

|

Winners & Losers – Barracuda Networks, Inc. (CUDA) Jumps UP (9.17%) After Company Beats Analyst Estimates for the Third Time With Growing Subscriber Base – Clearside Biomedical, Inc. (CLSD) Falls DOWN (13.39%) on Hold Pattern Before Announcing Two Clinical Trial Results Oct. 14th.

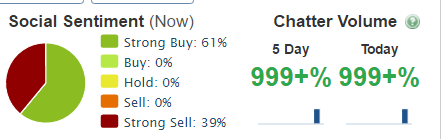

Most Talked About HTG Molecular Diagnostics, Inc. (HTGM) Shares Rise (37.17%) After Announcing Signing of Agreement with Merck; Seen as Strong Buy by Majority

The TIP Sheets -Wednesday, October 12th – Altisource Asset Management, Corp. (AAMC) Shoots UP (45.62%) on no News. Conditions Look EXTREMELY Overbought. Expect Shares to Crash DOWN.

Unusual Volume

– Shares of Telefonaktiebolaget LM Ericsson (ERIC) Crash DOWN (20.83%) on 58m Shares Traded After Announcing Disappointing Preliminary Third Quarter Results. Expect Shares to Drop DOWN Another 10-20% Before Leveling Out. |