Business

Electric Cars Projected to Make Waves Through Oil and Other Global Industries

For over a decade, the electric car has been heralded as the most world-changing and upcoming technology.

The demand for electric cars has been rising steadily every year, and Elon Musk’s Tesla, the most prominent electric car manufacturer, plans to sell 500,000 cars each year by 2018.

For context, this projected growth is even higher than the rise of the Model T in the early 1900’s.

Why Are People Demanding Electric Cars?

Electric cars’ energy efficiency, economic value, and potential to reduce some of the automobile industry’s most egregious environmental impacts are very strong selling points. These qualities have led the U.S. government to incentive consumers to purchase electric cars, promising a $7,500 tax refund to anyone who purchases the upcoming Model 3, Tesla’s first mass-produced car.

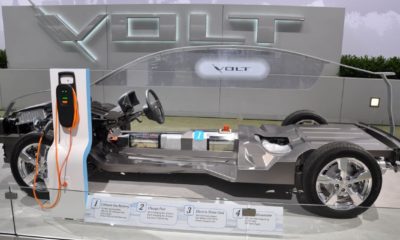

Many industries have jumped onto the surge in demand and interest, with Chevrolet coming out this year with its mass-produced electric vehicle. Governments in Europe, such as Germany, are also using tax incentives to encourage industry growth. Governments are also beginning to plan for the massive infrastructural changes which will need to occur, such as building charging stations and increased electric grid power.

Economic Impact of the Rise of Electric Cars

There are clearly many positive economic impacts of electric cars for consumers. Owners of hybrid vehicles will spend less money on gas, and owners of fully electric vehicles will spend nothing.

The clear economic benefit of the huge tax break means more money in consumers’ pockets, and thus more circulating in the economy. With driving made cheaper and easier, more people will travel, stimulating the tourism economy in many parts of the U.S.

Asian economies such as Korea, Japan, and China have also benefited through the creation of many jobs producing batteries for upcoming electric cars.

Importantly, the use of electric cars strongly decreases the amount of biomass being burned to fuel transportation. This decline in carbon dioxide emitted into the atmosphere would have not only human and environmental benefits but also economic benefits.

By halting some of the environmental damage we are doing now, we save millions of dollars down the road which would be spent on medical bills from pulmonary problems caused by smog and adapting and trying to clean up a heavily polluted atmosphere.

However, many have debated whether electric vehicles are actually as energy-conserving as they claim to be, as it takes a lot of energy to produce the batteries, and they are not suitable for cities experiencing energy shortages.

[ms_divider style=”normal” align=”left” width=”100%” margin_top=”30″ margin_bottom=”30″ border_size=”5″ border_color=”#f2f2f2″ icon=”” class=”” id=””][/ms_divider]

[ms_featurebox style=”4″ title_font_size=”18″ title_color=”#2b2b2b” icon_circle=”no” icon_size=”46″ title=”Recommended Link” icon=”” alignment=”left” icon_animation_type=”” icon_color=”” icon_background_color=”” icon_border_color=”” icon_border_width=”0″ flip_icon=”none” spinning_icon=”no” icon_image=”” icon_image_width=”0″ icon_image_height=”” link_url=”https://offers.thecapitalist.com/p/warrenbuffet/index” link_target=”_blank” link_text=”Click Here To Find Out What It Said…” link_color=”#4885bf” content_color=”” content_box_background_color=”” class=”” id=””]Warren Buffett Just Told His Heirs What He Wants them To Do With His Fortune When He Dies. [/ms_featurebox]

[ms_divider style=”normal” align=”left” width=”100%” margin_top=”30″ margin_bottom=”30″ border_size=”5″ border_color=”#f2f2f2″ icon=”” class=”” id=””][/ms_divider]

Negative Impacts

Despite the promises the electric car industry holds for a cheaper and cleaner transportation future, there are also some major economic consequences for producers heavily invested in the traditional automobile industry.

The most obvious example is oil. With the demand for oil declining as people switch to electric cars, oil producers will suffer from overproduction crises, massive price decreases, and potential total market crash. Recently, however, as oil prices have declined, fewer people have been interested in electric vehicles as an alternative.

Many oil-producing countries such as Saudi Arabia have positive relationships with the United States only because of the oil trade and are very politically tense. A crash of the oil market would destabilize many Middle Eastern countries and lead to potential political conflict.

However, as more cars are on the road, the oil industry will have to find alternative energy pathways forward regardless of whether electric vehicles rise to prominence.

Some Industries Which May Be Impacted

- Battery producers

- Electricity companies and power plants

- Utilities management companies

- Construction Industry (for development of charging infrastructure)

- Aluminum, Nickel, and Platinum

Impact on the Platinum Industry

Oil is not the only industry which will experience difficulties as electric cars gain popularity.

Another key player is the platinum industry.

The automobile industry makes up nearly half of the total market for platinum because platinum is an important element in purifying air emitted from the exhaust pipes of cars.

Electric cars require no platinum to manufacture, so platinum producers would lose half of their demand if everyone switched to electric. However, this is not necessarily inevitable.

Car producers are also looking into the creation of hydrogen-cell powered cars, including Toyota, which released a hydrogen-cell vehicle in 2015. These cars use hydrogen as their primary fuel source, and hydrogen cells are already proven to be effective through their use in space rockets. Hydrogen-powered cars use a large amount of platinum in production, so this could stimulate the platinum market.

Impact on Battery Producers

Many investors are predicting that as oil declines as the most globally important market, the battery manufacturing industry will rise to take its place. Battery manufacturers will also have to adapt and change significantly from their current production models.

Instead of chemistry at the battery cell level, they will have to begin focusing on how their batteries will work as an aggregate system in the vehicle. Producers will have to work more closely with manufacturers of other automobile parts than every before.