Economy

Even The Stock Market Doesn’t Want “Sleepy Joe” Biden As President

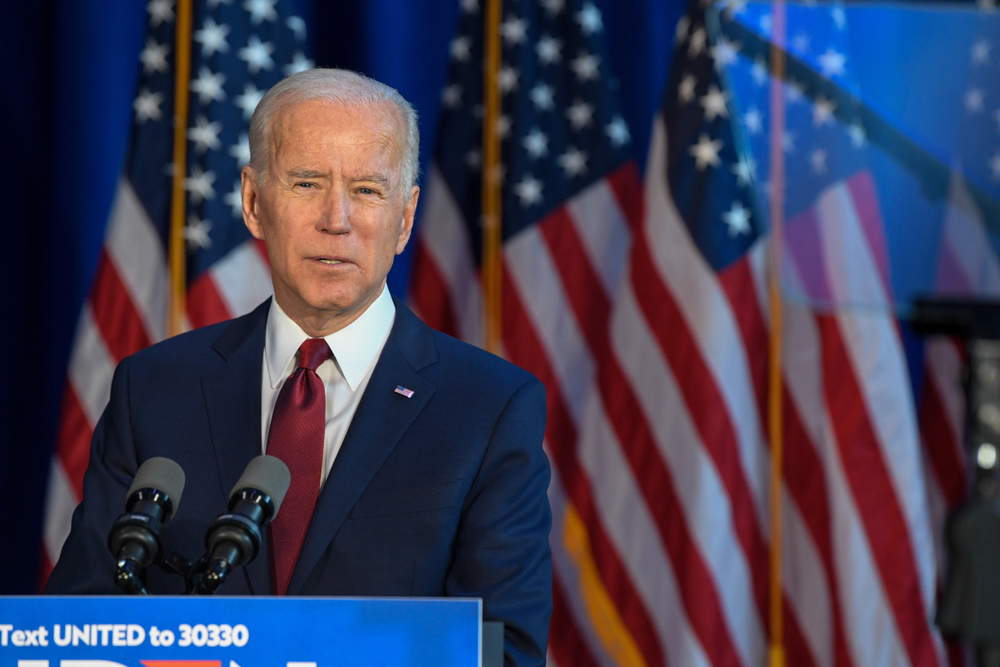

Add “bad for the stock market” to the long list of reasons why nobody wants “Sleepy Joe” Biden to win the election in November.

Biden has said he would partially reverse the Tax Cuts and Jobs Act put into place by President Trump. He would also enact other measures like higher taxes on capital gains and dividends for high earners and changes in non-tax regulatory policies.

In 2017, the Tax Cuts and Jobs Act lowered the US corporate tax rate. It went from the highest in the world, at 35 percent, down to 21 percent. Analysis by the Tax Foundation shows that Biden’s plan would increase the corporate tax rate to 28 percent.

According to David Kostin, chief U.S. equity strategist at Goldman Sachs, the Tax Cuts and Jobs Act has reduced the effective tax rate of S&P 500 companies by 8 percentage points to 19 percent while also boosting S&P 500 earnings by 10 percent.

Biden’s plan to raise the corporate tax rate will act as a bucket of cold water on the stock market. It would do so by dragging down corporate earnings.

Possible Impact

Michael Wilson, the chief US equity strategist at Morgan Stanley, says “Extrapolating current multiples on that kind of earnings decline makes 100-150 points on the S&P 500 a baseline for the impact of a tax cut rollback, all else equal.”

“Of course, any impact on investor confidence that drags the multiple lower, or business investment, that drags economic growth lower could compound this effect,” Wilson added.

Higher corporate taxes also further burden companies that are still struggling to recover from the economic lockdowns due to COVID-19.

Expectations are for our country’s output to fall as much as 50% in the second quarter due to the restrictions. This comes with a 20-30% rebound in the third quarter and a modest 5-10% rebound in the fourth quarter. All this assumes that we don’t experience a second outbreak this fall.

Reactions

“Although the coronavirus has caused the sharpest decline in economic activity on record, in some ways tax policy represents a larger risk to earnings and consequently to equity prices,” added Kostin.

Greg Valliere, chief U.S. policy strategist at Ontario, Canada-based AGF Investments, shared a warning. He says that if that Biden wins the November election, he shouldn’t be in a rush to raise taxes. He deems this idea bad, given the uncertainty of our economic recovery.

Valliere says Biden “needs to be careful in talking about a big tax increase early next year. I'm not sure a tax increase is a good idea in early 2021 as the jury will still be out on the extent of the recovery.”

Matt Gertken, a geopolitical strategist for BCA Research, says you can watch the market over the next month or two. Doing so will let you have an idea of who Wall Street thinks will win the election.

“Either the market sells off in the short run to register the currently likely victory of Joe Biden, who will hike taxes, wages, and regulation, or the market rallies all the way till the election, increasing the chances of President Trump’s reelection, which would revolutionize the global system, especially on trade, and would require a selloff around December.”

Up Next: