Business

Roach: The Case For A Double Dip In The Economy

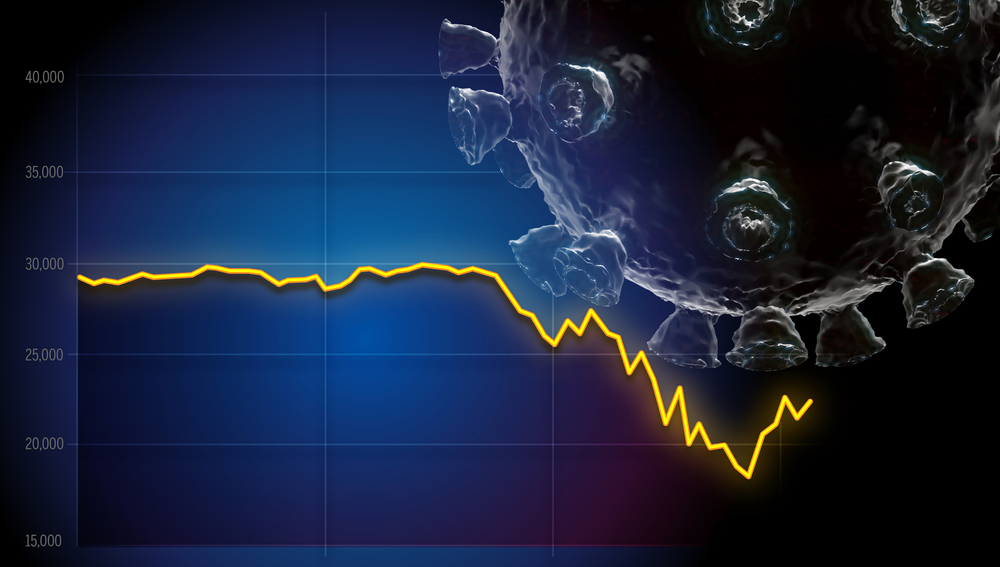

Stephen S. Roach, a faculty member at Yale University and former Chairman of Morgan Stanley Asia, says we should prepare for another plunge in the economy. He said to get ready as the recovery from the pandemic teeters on the edge.

Roach says that a double-dip is a “time-honored tendency” in a recent article. He also says we will likely see another leg down in the markets.

“The double dip is not a dance. It is the time-honored tendency of the US economy to relapse into recession after a temporary recovery. Over the years, it has happened far more often than not,” says Roach.

The Double Dip

Historically, the only times we’ve escaped a double-dip was when the initial downturn was mild. Significant downturns like the one we just experienced have always had a second plunge.

“Double dips – defined simply as a decline in quarterly real GDP following a temporary rebound – have occurred in eight of the 11 recessions since the end of World War II. The only exceptions were the recessions of 1953-54, the brief contraction of 1980, and the mild downturn of 1990-91. All the others contained double dips, and two featured triple dips – two false starts followed by relapses.”

He adds, “As a general rule, the more severe the downturn, the greater the damage, the longer the healing, and the higher the likelihood of a double dip. That was the case in the sharp recessions of 1957-58, 1973-75, and 1981-82, as well as in the major contraction that accompanied the 2008-09 global financial crisis.”

Economy Not Necessarily Healed

The coronavirus still has no vaccine and large parts of the economy still struggling to survive. With this, Roach warns that the “recovery” was virtually guaranteed by the partial reopening, and not a true sign of a healed economy.

“The current recession is a classic set-up for a double dip. Lingering vulnerability is hardly a question in the aftermath of the 32.9% annualized plunge in the second quarter of 2020 – by far the sharpest quarterly decline on record. Damaged as never before by the unprecedented lockdown to combat the initial outbreak of COVID-19, the economy has barely begun to heal. A sharp rebound in the current quarter is simple arithmetic –and virtually guaranteed by the partial re-opening of shuttered businesses.”

Roach says this partial recovery, is an “asynchronous normalization” that makes the recovery vulnerable. This recovery comes with some parts of the economy doing well. Meanwhile, other parts, like retail, travel, and restaurants is still being decimated.

“Therein lies the case for a double dip. Partial and asynchronous normalization in the aftermath of the worst economic shock on record signals lingering vulnerability in the US economy. And failure to contain the virus underscores the distinct possibility of aftershocks. This is precisely the combination that has led to previous double dips. Yet frothy financial markets are wedded to the narrative of a classic V-shaped recovery. The rhymes of history suggest a very different outcome,” he also says.

Up Next: