Inflation fears are weighing on the market after last month’s consumer price index posted its largest annual increase in more than three decades.

Paul Christopher, head of global market strategy at Wells Fargo Investment Institute, said he believes inflation will moderate in 2022, but that “the path to lower inflation [will] begin with higher inflation in the front half of the year.”

“The stickier drivers of inflation are likely to persist, but our base case is that they will not outweigh the improvement we expect in the transitory elements,” he wrote in a note to clients.

Walmart kicks off a busy week of retail earnings on Tuesday before the market opens, which will give investors a look at how much consumers are spending.

Home Depot also reports before the market opens, while Target will post results on Wednesday.

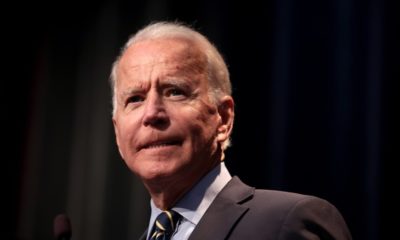

On Monday afternoon President Joe Biden signed the $1 trillion bipartisan infrastructure bill into law. The package includes funding for transportation, broadband, and utilities.

The major averages are coming off their first negative week in six, but stocks are still trading around all-time high levels.

As Wall Street strategists look to 2022 some, including Morgan Stanley’s Michael Wilson, believe the picture looks muted.

“With financial conditions tightening and earnings growth slowing, the 12-month risk/reward for the broad indices looks unattractive at current prices,” he said Monday in a note to clients.

“However, strong nominal GDP growth should continue to provide plenty of good investment opportunities at the stock level for active managers,” he added.

His 12-month base target for the S&P 500 is 4,400, which is 6% below where the index closed on Monday.

Stock Futures Little Changed as Investors Await Economic Data, Earnings

You Might Also Like:

- China Overtakes US to Grab No. 1 Spot In Global Wealth List

- Biden Signs $1 Trillion Infrastructure Bill Into Law

- United States: Potential Tax Law Changes Hang Over Year-End Tax Planning 2021 For Individuals

Keep up to date with the latest finance news by following us on Facebook and Instagram.

Article Source: cnbc.com