Business

Stocks Are Supported By Nothing But An ‘Ideological Dream’ Warns Analyst

Albert Edwards, an economist at Société Générale, is out with his latest research note and the self-described “uber-bear” doesn’t disappoint.

“We are in the midst of a monetary and fiscal ideological revolution. Nose-bleed equity valuations are being supported by nothing more than a belief that a new ideology can deliver,” he wrote. “Meanwhile the gap between the reality on the ground and expectations grows wider.”

To be fair, other “doom and gloom” predictions from Edwards haven’t come to pass.

Economic Predictions

In early 2016 Edwards said the S&P 500 could fall as much as 75%. The S&P fell around 9% before recovering and marching higher.

This time around, however, Edwards’ predictions come against a backdrop of 30 million unemployed Americans, an economic lockdown and a potential record-setting drop in GDP output this quarter.

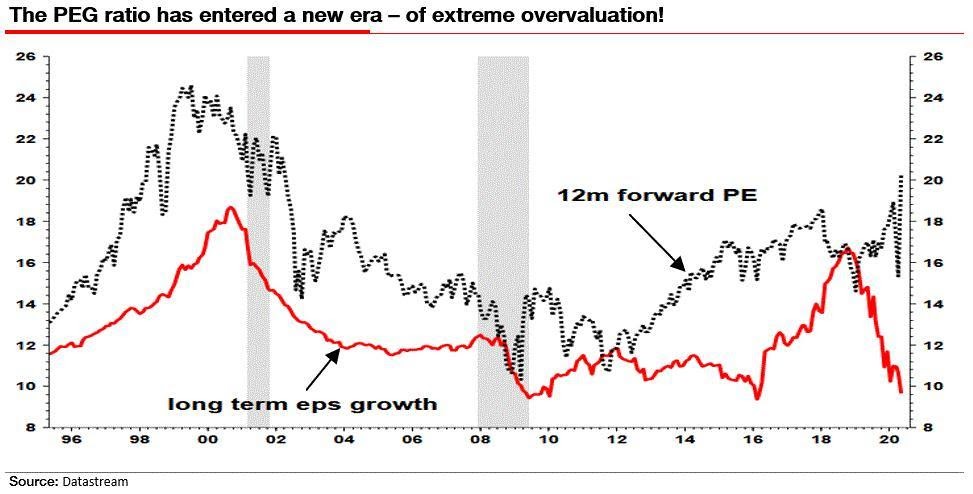

Edwards points to the price-to-earnings growth (PEG) ratio. It shows “how ludicrous current equity valuations have become and by implication how vulnerable equities are to a collapse.”

You can see the chart below, which is a “showstopper,” according to Edward. He says the reading just went above 2x for the first time in history. For comparison, a 1x reading generally means a stock is considered overvalued relative to its long-term earnings growth expectation.

Edwards says the last time the ratio was this high was during the dot-com bubble. However, that bubble at least had the expectations of long-term earnings-per-share growth.

“Compare the current situation with the late 1990s tech bubble. Then too the S&P forward PE (price-to-earnings) rose above 20x, but at least back then the cycle was still intact, and as technology stocks increasingly dominated the index, the market’s LT eps (long-term earnings-per-share) was also surging higher in tandem with the rising PE. At least back then the market had a LT eps leg to stand on albeit a wooden leg, riddled with woodworm. By contrast, this time around, despite technology stocks once again dominating the index, the 20x PE is based on nothing more than an ideological dream.”

Preventing to Turn an Ideological Dream Into a Nightmare

The Federal Reserve is doing everything it can to keep that “ideological dream” from becoming a nightmare. It does so by slashing interest rates to zero and bailing out companies and entire industries. It also does this by propping up market liquidity with bond ETF purchases and other quantitative easing measures.

In a series of tweets, Edwards compares the Fed’s efforts to a heavyweight boxing match between Thomas Hearns and Marvin Hagler.

In the fight, Hearns came out and put everything he had into the first round, leaving nothing in the tank.

“This equity bear market is going to be brutal. We have only just finished round 1.”

Edwards added, “Maybe like Thomas Hearns the Fed went out too early with all guns blazing in round 1 and the bear market is going to find the Fed out. Each successive Fed bailout is like Hearns stepping up a weight only to overextend himself. The Fed may now be fighting well beyond its capabilities.”

Regarding the elevated price-to-earnings ratio of the S&P 500 right now, officially the highest in the last 10 years, Edwards painted quite the picture in a late-April tweet.

“This is either an example of a Fed steroid induced attempt to ‘look through the earnings valley', or a drug-induced climb up to an even higher valuation diving board in a hallucinogenic attempt to fly, only to plummet into an empty swimming pool drained of earnings. Maybe both!”

Up Next: