Bankruptcy

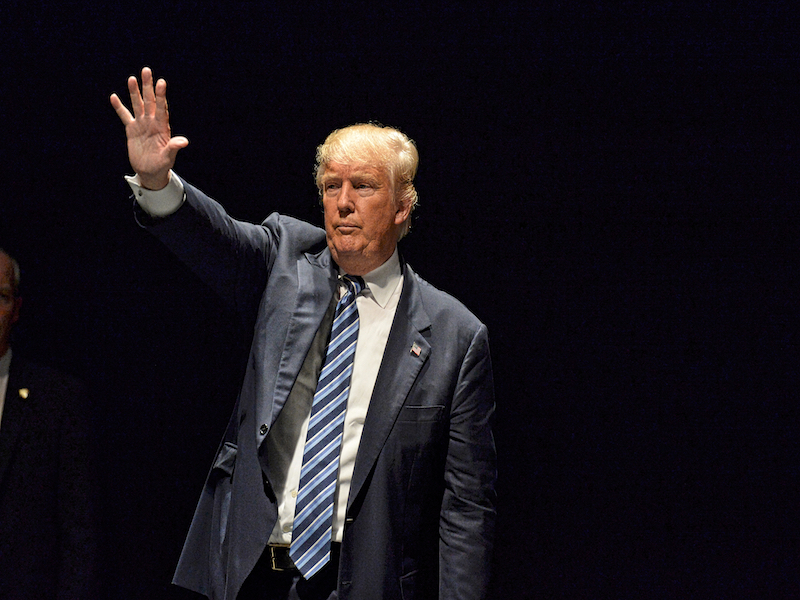

Trump’s Bankruptcies: Why, When and How

Does Trump Having Bankruptcies Make Him Inept As A Leader?

Join The Conversation Below In The Facebook Comments

In 2015, Carly Fiorina alleged that Donald Trump has filed for bankruptcy four times. She claims this makes him a risky choice for the job of president. Trump’s responses to such allegations speak volumes about his sense of personal responsibility.

First, Trump accurately states that he has never filed for personal bankruptcy

There are several kinds of bankruptcy under United States’ Law, some involving liquidation and others rehabilitation. The bankruptcy that Trump filed for on four separate occasions was Chapter 11 bankruptcy. It affected the assets of the companies he filed on behalf of while letting him personally scot-free.

To fully understand why it is necessary to summarize what Chapter 11 bankruptcy is.

What are the basic features of Chapter 11 bankruptcy?

- The company or individual is allowed to keep some of its assets under the following condition: The debtors must submit a plan to restructure their company, so it has a chance to recover and repay its creditors.

- Corporations and LLCs may file under Chapter 11 as though they were individuals.

- Owners of LLCs and corporations are not liable for the bankruptcy. The LLC or the corporation is.

Trump’s First Failing Was the Costliest to Him Personally

Trump’s first major investment to go bankrupt was the Atlantic City Trump Taj Mahal Casino in 1991. He was forced to use junk bonds at 14-percent interest to finance it. In spite of his assertions that it would be a great business, the economy just could not support the venture.

Ultimately, the business filed for Chapter 11 bankruptcy. He was forced to give up 50% of his share in the organization. He blamed the failure, not entirely unjustly, on the bad economy at the time.

[ms_divider style=”normal” align=”left” width=”100%” margin_top=”30″ margin_bottom=”30″ border_size=”5″ border_color=”#f2f2f2″ icon=”” class=”” id=””][/ms_divider]

[ms_featurebox style=”4″ title_font_size=”18″ title_color=”#2b2b2b” icon_circle=”no” icon_size=”46″ title=”Recommended Link” icon=”” alignment=”left” icon_animation_type=”” icon_color=”” icon_background_color=”” icon_border_color=”” icon_border_width=”0″ flip_icon=”none” spinning_icon=”no” icon_image=”” icon_image_width=”0″ icon_image_height=”” link_url=”https://offers.thecapitalist.com/p/warrenbuffet/index” link_target=”_blank” link_text=”Click Here To Find Out What It Said…” link_color=”#4885bf” content_color=”” content_box_background_color=”” class=”” id=””]Warren Buffet Just Told His Heirs What He Wants them To Do With His Fortune When He Dies. [/ms_featurebox]

[ms_divider style=”normal” align=”left” width=”100%” margin_top=”30″ margin_bottom=”30″ border_size=”5″ border_color=”#f2f2f2″ icon=”” class=”” id=””][/ms_divider]

Trump’s Second Corporate Bankruptcy Again Saw Him Forced Out of Authority

Trump’s second venture to go bankrupt was the Trump Plaza Hotel in 1992. Again, it ended up in crippling debt. Furthermore, he was again required to give up almost half his stake in the venture and any control over how the hotel was run.

Trump’s Third Corporate Bankruptcy Came Because of 1.8 Billion Dollars of Debt

In 2004, Trump’s casinos were struggling again. They filed under Chapter 11. While he remained in charge of the organization, he still lost almost half of his shares as part of the restructuring agreement.

Finally, Trump’s Last Bankruptcy Resulted in His Stepping Down as Chairperson

Trump Entertainment Resorts was struck in 2009 by the economic recession and could not supply a sizeable interest payment.

They filed for Chapter 11 bankruptcy, and Trump’s corporate stake went down to a mere 10 percent. The company continued to use his name as the valuable brand it was but wanted no further guidance from Donald Trump the man.

What Donald's Opponents Have to Say About What This Means for His Candidacy

- That he lost a great deal of other people’s money with little cost to himself.

- That he destroyed jobs and swindled lenders.

- That he mismanaged his investments so badly that he went into corporate bankruptcy four times in 25 years—a record-setting number.

What Trump Has to Say on the Matter

Trump maintains that his Chapter 11 bankruptcies were a smart, appropriate action to take in all cases. He says that other companies take advantage of them all the time. He was merely being a savvy businessman in using the laws that are in place for such situations.

He implies that the same characteristics which make him willing to file for bankruptcy would make him a good president. He feels that the United States is currently in the kind of debt that merits bankruptcy protections.

Furthermore, he mostly blames the failure of some of his ventures on market forces. Though he did take risks in his investments, this is a hard argument to refute. His bankruptcies took place during downturns in either casinos or the economy in general.

Is the Backlash Against Trump Fair?

Trump did opt for Chapter 11 bankruptcy, which allowed the companies to survive in some form rather than being liquidated.

Trump Expands Position on Tax Cuts –> https://t.co/IVICRvebdV pic.twitter.com/9oAmLr6e9w

— The Capitalist (@Capitalist_Site) May 13, 2016

Law professor Adam Levitin goes so far as to suggest that the real reason people are taking it so personally is that Trump puts his name on everything. People then assume that Trump the man is responsible for every decision and roast him like any other celebrity.

One Atlantic City lawyer, credited only as Viscount, goes so far as to say that the lenders are the ones at fault. He feels they should have known better, but they lent to Trump because of his name and branding.

The Controversy Continues

Apparently, some people feel that Trump’s bankruptcies are an indication of a poor businessman. They recognize that he takes no personal responsibility for the failings of his businesses. Their fear is that he would fail the United States Government as he has failed some of his business ventures.

Others feel that the bankruptcies were due to market factors over which he had no control. They feel the bankruptcies should not be used to judge his character.

Either way, it looks as though voters will have to decide the final outcome.