Bonds

Valeant Still Dovish…But Where’s Hope?

Valeant Still Dovish…But Where's Hope?

This has been a rough week for Valeant Pharaceutical's.

After a less the perfect earning report on Wednesday, Valeant's stock plunged 51%. On Thursday the stock fell 9 points more.

This all after Valeant CEO Michael Pearson let a $600 Million dollar typo pass by.

Investors have been punishing the stock lately but there are bullish cases for the current price, regardless of the many obstacles Valeant needs to overcome.

There is seemingly no end to Valeant Pharmaceuticals International’s pain. But that creates opportunity for debt investors with a strong stomach.

Valeant’s stock fell sharply yet again on Thursday and is now down 90% from last summer’s record. The latest plunge came after Valeant on Tuesday reported disappointing fourth-quarter figures and said it is in danger of breaching debt covenants due to financial-reporting issues.

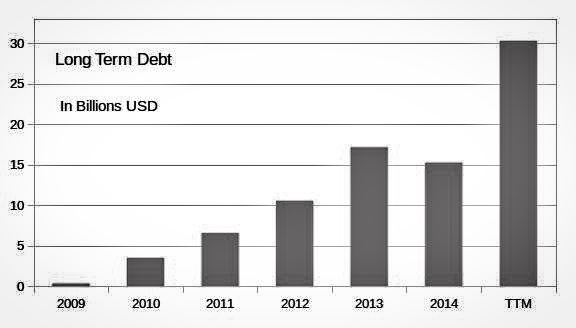

This has caused prices to slide across Valeant’s more than $30 billion in debt. A senior bank loan maturing in 2020, for example, is quoted around 93 cents on the dollar; some unsecured notes fetch as low as 73 cents, according to FactSet. Those prices reflect too much fear, though.

Granted, there is good reason for debt-price divergence. Loans account for roughly $12 billion of Valeant’s debt, which are secured by company assets. There is also a $1.5 billion bank revolver. The remainder is mainly notes that are unsecured, which makes potential recovery rates harder to predict.

That uncertainty is exacerbated by Valeant’s current predicament. For starters, investors don’t have audited 2015 financial statements. And Valeant’s future guidance seems highly uncertain.

The company expects about $6 billion in adjusted earnings before interest, taxes, depreciation and amortization over the next four quarters. But more than half of Valeant’s recent top 30 selling brands saw sequential declines in 2015’s fourth quarter.

[buffet_recommended]

Among decliners were two of Valeant’s best selling drugs, Xifaxan and Jublia. That puts the spotlight on longstanding fears Valeant’s old business model of buying drugs and raising prices won’t work any longer as payers and regulators push back.

Still, it is tough to see a scenario in which the secured loans aren’t repaid. That would entail the company’s stock market value of around $10 billion being wiped out and recoveries on its total debt of less than 50%.

So the secured loans seem to offer the potential for solid returns. While those may not be spectacular, they are juicy in light of low yields on offer elsewhere.

And don’t write off the unsecured bonds yet, at least not at these prices. Analysts at Gimme Credit, a bond research firm long wary of Valeant, expect the covenant breach “will be cured…or resolved without any risk that puts the company in bankruptcy.”

Valeant doesn’t appear to be at risk of default because it can’t make interest or debt payments. Even if Valeant’s Ebitda came in at just 50% of expected levels, this should still exceed annual interest expense by almost $1 billion.

A bankruptcy filing due to a technical default is less likely. Given that, at around 75 cents on the dollar, some unsecured notes offer potential for significant returns, albeit with more risk.

A possible threat would be if some holders push for accelerated repayment of debt. That, though, would likely be resolved with a special payment by the company.

This is little comfort to stockholders. But opportunistic debt investors don’t have to share their pain.

Source: http://www.wsj.com/articles/valeant-where-to-hunt-for-value-1458243880