|

On Wednesday, President-Elect Donald Trump announced the creation of a new advisory board; The White House National Trade Council. Trump also announced his pick for head of the new council; Peter Navarro, economist author of “Death by China”. Tapping Navarro as head of the new NTC sends a not-so-subtle message to China. But how much power will Navarro really have?

Read The Capitalist’s Take Here

Read More at New York Times

Read More at Wall Street Journal

U.S. SUES BARCLAYS OVER ALLEGED MORTGAGE SECURITIES FRAUD

The Department of Justice sued British banking giant Barclays plc and several of its U.S. affiliates Thursday for allegedly deceiving investors who were sold mortgage securities in the years leading to the financial crisis. Barclays representatives repeatedly misrepresented the investment quality of residential mortgage-backed securities they sold to investors from 2005-2007, the lawsuit charged. As a result, investors from around the world who bought the securities suffered billions of dollars in losses, DOJ officials charged.

Read More at USA Today Here

Read More at Reuters Here

Read More at ABC News Here

UBER’S SELF DRIVING CARS PROJECT FORCED TO LEAVE SAN FRAN; MOVES TO ARIZONA

Just one day after Uber was forced to shut down its self-driving car program in San Francisco, the company is moving its cars to Phoenix, the company said on Thursday. “Our cars departed for Arizona this morning by truck,” an Uber spokesperson said in a statement of the fleet of modified Volvo XC90 cars. “We’ll be expanding our self-driving pilot there in the next few weeks, and we’re excited to have the support of Governor Ducey.”

Read More at Fortune Here

Read More at The Verge Here

Read More at CNET Here

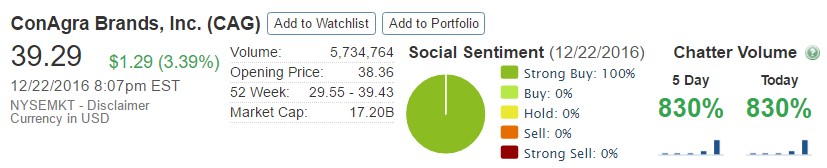

Closing Bell

– Thursday, December 22nd

Markets Edge Lower in Quiet Session as Holidays

Big Insider Trades

– ServiceNow, Inc. (NOW) Director Frederic Luddy Sells $7.3m

-Gran Tierra Energy, Inc. (GTE) Director Ronald Royal Buys $350k

|