|

Apple made a big deal about its launch of Apple Pay. Expectations were through the roof as the iPhone maker was poised to revolutionize digital currency through customers’ phones. But that never happened. In fact, people hated Apple Pay. Apparently, Apple isn’t giving up, though. After seeing the wild popularity of PayPal subsidiary Braintree’s Venmo, a peer to peer payment system, Apple is giving it another go. What’s going to be different about this version of Apple Pay? Should Apple just give up already?

Read More at Fox Business Here

Read More at CNBC

Read More at The Wall Street Journal

TRUMP SIGNS EXECUTIVE ORDER OPENING UP OFFSHORE DRILLING IN THE ARCTIC, ATLANTIC OCEANS

President Trump signed an executive order Friday that could lead to the expansion of drilling in the Arctic and Atlantic oceans, saying it will reverse his predecessor's Arctic leasing ban and create “great jobs and great wealth” for the country.

Trump said the executive order, titled “Implementing an America-First Offshore Energy Strategy,” will direct a “review of the locations available for off-shore oil and gas exploration” and related regulations.

Read More at Fox News Here

Read More at Washington Post Here

Read More at The Verge Here

NORTH KOREA LAUNCHES FAILED MISSILE TEST IN SPITE OF WORLD PRESSURE

North Korea test-fired a ballistic missile on Saturday shortly after U.S. Secretary of State Rex Tillerson warned that failure to curb Pyongyang's nuclear and ballistic missile programs could lead to “catastrophic consequences”. U.S. and South Korean officials said the test, from an area north of the North Korean capital, appeared to have failed, in what would be the North's fourth straight unsuccessful missile test since March. The test came as the USS Carl Vinson aircraft carrier group arrived in waters near the Korean peninsula, where it began exercises with the South Korean navy on Saturday, about 12 hours after the failed launch, a South Korean navy official said.

Read More at Reuters Here

Read More at CNN Here

Read More at NY Times Here

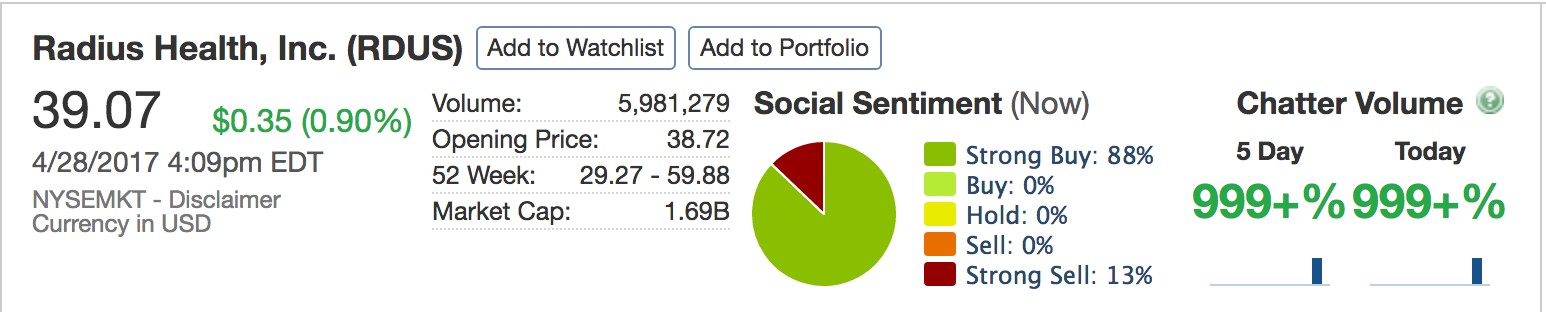

Closing Bell

– Friday, April 28th

Markets Tick DOWN as Financials Sag

Big Insider Trades

– VRTX (VRTX) CEO Jeffrey Leiden Sells $18.75m

– Twitter, Inc. (TWTR) CEO Jack Dorsey Buys $9.5m

|