Stock Picks

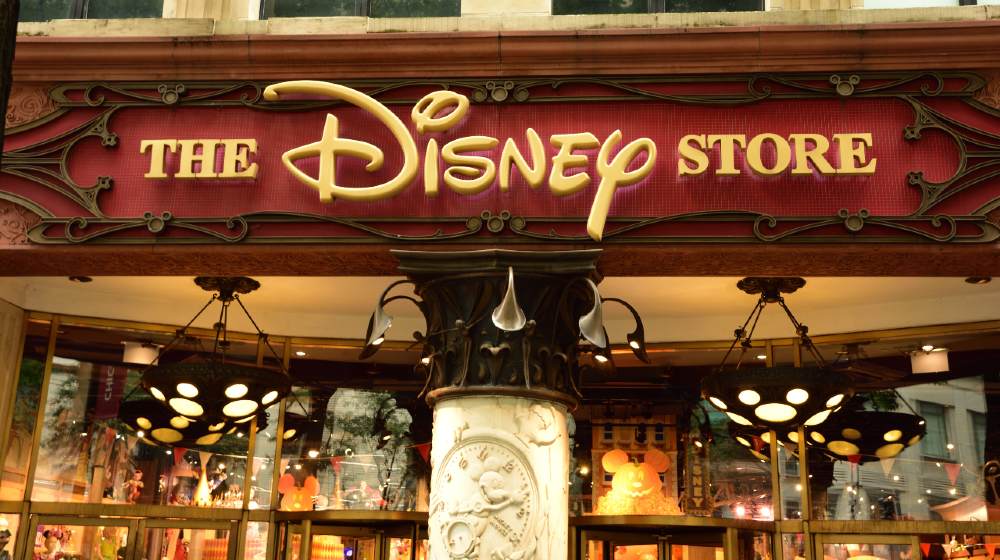

Disney Stores To Close As Firm Shifts to E-commerce

On Wednesday, entertainment titan The Walt Disney Co announced they will close around 20% of its physical Disney stores by the end of the year. This move is part of its move to focus more on its e-commerce business. As a result, 60 of its North American locations will close.

News For The Day: Bipartisan Bill To Ban Lawmakers From Trading Stocks

5 Stocks to Watch Out For Thursday, March 4

Michaels Companies Inc ▲(MIK 22.02 USD +4.00 (22.20%)) stocks soared 22.20% yesterday after getting into acquisition talks with Apollo Global Management. Apollo will acquire all Michaels stock for $22 per share totaling $3.3 billion. The offer price provides a 47% premium to Friday’s closing price.

Lumen Technologies Inc ▲(LUMN 13.79 USD +0.94 (7.32%)) stocks jumped 7.32% during yesterday’s trading. Wednesday was the tail-end of a three-day streak of gains for the telecommunications company. Lumen Technologies’s sales growth is a negative 8.2% for the present quarter and a decline by 3.9% for the next. Despite the recent losses, analysts expect a break-even quarter and a possible profit of US$1.6 billion within 2021.

LYFT Inc ▲(LYFT 61.76 USD +4.70 (8.24%)) shares rose 8.24% higher along with other ride-sharing stocks in an otherwise dismal day for tech stocks. Investors flocked to Lyft after the company said it’s seeing rideshare recovery sooner than expected. Even Uber got into the act, closing with a gain of 2.6%. Analysts foresee the mobility business beginning to show signs of recovery although it’s “too early to tell.”

Palantir Technologies Inc ▲(PLTR After hours 24.84 +1.25 (5.30%)) stocks endured last week’s bloodbath and started regaining upward momentum. Palantir needs to gain a bit more to make up for its 17.6% drop last week. It’s been a while since Palantir went up 285% between October 2020 to its highest close of $39.00 on Jan. 27.

GameStop Corp. ▲(GME 124.18 USD +6.00 (5.08%)) stocks continue to rise with Reddit’s wallstreetbets investors leading the charge. GME stock went up to almost $128 before settling down to $124.18, and it climbed a bit more. The departure of CFO Jim Bell paved the way for activist investors led by Ryan Cohen to continue with their plans to improve GME’s long-term plans.

You Might Also Like:

- Disney Will Now Focus on Streaming

- Disney Splits From Netflix

- Warner Bros 2021 Movies To Play On HBO Max

Keep up to date with the latest finance news by following us on Facebook and Instagram.