Business

Biden’s ‘Made In America’ Initiative Crippled By His Own Economic Plan

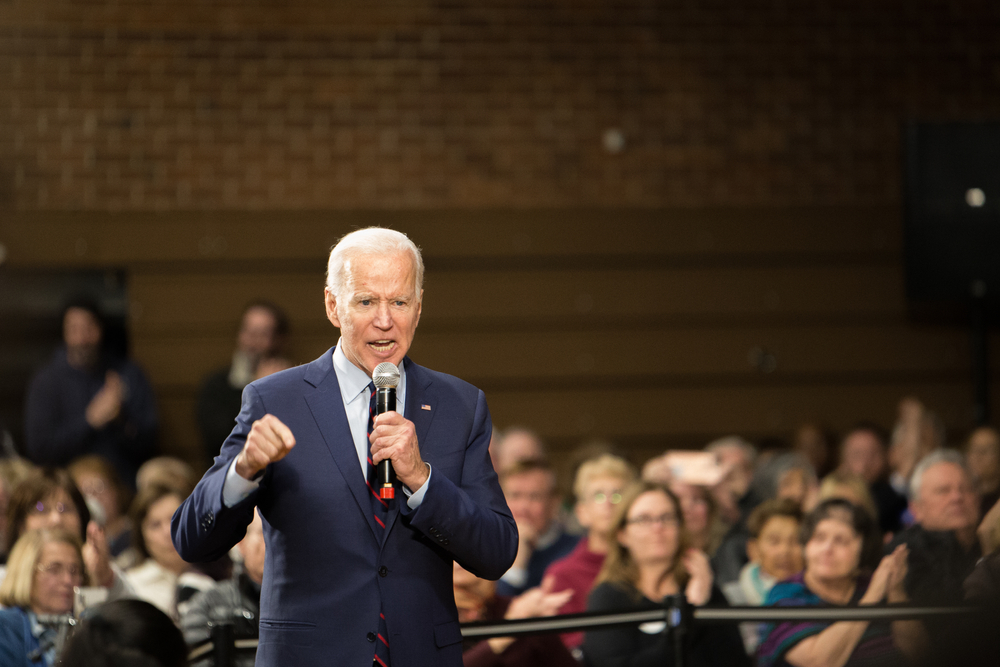

Democratic nominee Joe Biden released his “Made in America” plan last week. However, at least one critic says none other than Joe Biden himself will fail the plan.

Brian Brenberg, a professor of business and economics at The King’s College in Manhattan, says Biden’s “Made in America” plan is a list of “vague promises” that directly conflict with his own economic plan.

“It amounts to a laundry list of vague promises to create jobs, increase federal spending by hundreds of billions of dollars, and raise taxes on U.S. companies with overseas operations. But the biggest threat to Biden’s “Made in America” goals is his own economic plan,” says Brenberg.

He says if Biden really did want to strengthen businesses and bring back workers, he would make America the greatest country in the world to start a business. But his actions say differently.

“If he were really serious about strengthening businesses and workers here at home, his first step would be to make America the best place on earth to build businesses. That means cutting — not increasing — taxes and regulations he’s already put on the table.”

Flaw's in Biden's “Made in America” Plan

Biden’s errors are limited to just his “Made in America” plan, says Brenberg. They also spill over into his “Green New Deal,” however. It was jammed full of “massive new growth-killing taxes, spending, and regulations,” they said. This was all done by the Bernie Sanders-socialism side of the aisle.

The Made in America plan calls for higher taxes on corporations, income, investments, inheritance and social security. Brenberg says the majority of these tax increases are supposed to impact only wealthy individuals. Those are the people who make more than $400,000 per year in income.

The problem though, is that Biden’s new taxes won’t raise enough from the wealthy to cover all the new spending he’s proposing. According to Brenberg, Biden’s tax hikes will raise between $3-4 trillion. This is far too little to cover his $11 trillion in new spending.

“Middle class Americans shouldn’t be surprised when they get pressed into paying for the shortfall,” says Brenberg.

Doing the Opposite of the Intention

He adds that taken as a whole, Biden’s plan disincentives anyone from starting new businesses in the US.

“When you add it all up, making things in Joe Biden’s America is going to be more costly, more complicated, and far less attractive to many companies and would-be entrepreneurs.”

Biden’s camp knows this, which is why Brenberg says the plan specifically penalizes companies for trying to leave the US and move their headquarters or operations to countries with lower taxes.

Tax-inversions, many know them as, spiked during the Obama years when companies fled high taxes here for more favorable locations. That all stopped, says Brenberg, with the Trump tax cuts in 2017. But a Biden victory in November will cause many companies to once again look to move out of the country. Penalizing them is the wrong approach.

“Threatening even more new taxes and rules to keep that from happening is not the answer.”

Encouraging “Made in America”

There is only one way to encourage “Made in America,” according to Brenberg. That is to make it the best place on earth to start and run a business. However, Biden’s plan will do the opposite.

“'Made in America' works when America is the best place on the planet to start, grow, and invest in a business. That means keeping taxes low, ensuring regulations aren’t burdensome and avoiding utopian schemes to reinvent the economy based on radical ideology.”

“Right now, Joe Biden’s economic plans are failing on all three of those counts,” he says. Brenberg also adds that “no amount of government giveaways, government threats, or ‘Made in America' branding will make up for it.”

Up Next: